SUMMARY

The Fund rose a pleasing 19.6% in February, also recording a 51% one-year return.

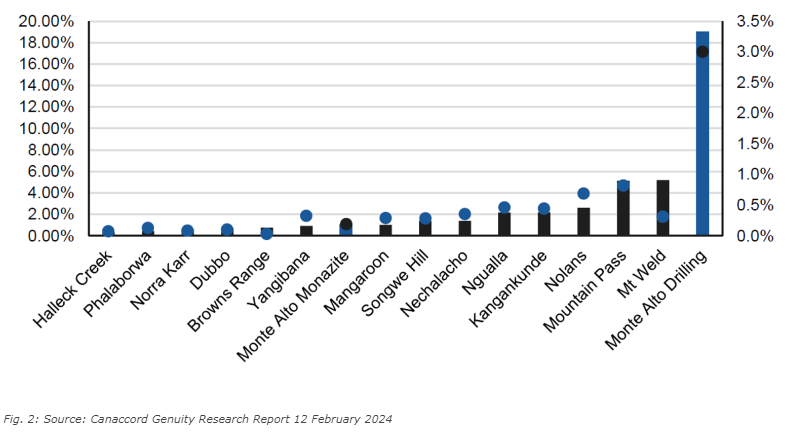

The Fund’s notable monthly performance included Brazilian Rare Earths‘ 74% surge in groundbreaking drilling results, IperionX‘s 25% rise driven by promising cost and revenue projections and Clarity Pharmaceuticals‘ 23% increase following positive Phase 2 study results in prostate cancer diagnosis. Other notable gains include CTS Eventim and Genetic Signatures, rising 17% during the month.