SUMMARY

Global equities endured a challenging month, with persistent inflation and some economic strength fuelling market fears that central banks will not ease monetary policy as quickly as previously hoped. This economic resilience and the danger of an escalation in the Middle East boosted energy prices, which when coupled with lower interest rate sensitivity supported the outperformance of value over growth companies as well as non-sustainable over sustainable companies.

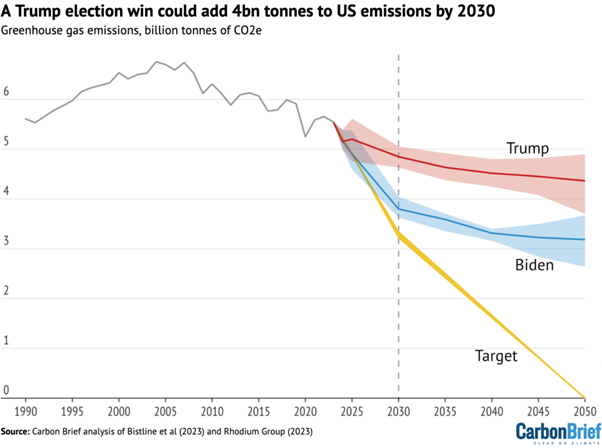

In this month’s commentary, Victoria MacClean delves into the complex mix of issues including climate policy, trade policy and regional protectionism, and the demand environment. With these factors pointing in different directions in terms of whether they are “good” or “bad” for sustainability, Victoria looks at how they are influencing our near- and longer-term thinking.