SUMMARY

Israel’s share market experienced its worst month since the start of the global pandemic in March 2020. The decline largely reflected local economic uncertainty following the 7 October terrorist attacks on Israel and subsequent military action. Much of the market fall took place in the two days following these initial tragic events.

The Fund returned -8.6% (Class A, AUD) and -8.5% (Class B, USD) in October, while the TA 125 Index returned -11.5%.

Global share markets continued to weaken during the month as fears that interest rates would remain ‘higher for longer’ drove longer-term bond yields up. The economic slowdown is starting to impact some company earnings, putting further pressure on market valuation levels.

October 2023 will be remembered as one of the most challenging periods in Israel’s history. The investment team at Alpha is extremely grateful for the enormous number of supporting e-mails received from investors over the past month.

Almost everyone in Israel has been impacted by the tragic events of 7 October. Thankfully, all members of the Alpha team are safe and as well as can be expected in the circumstances. The office has remained open throughout, and the team is focused on delivering business as usual to our investors while supporting efforts to help the broader community.

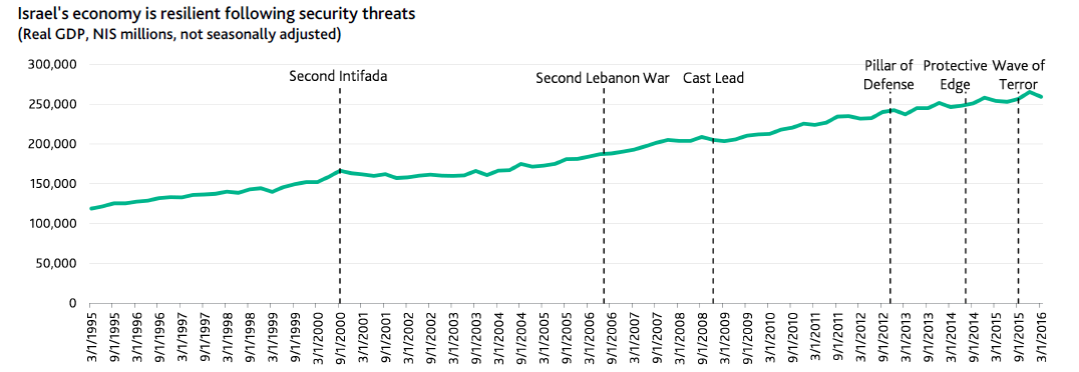

Whilst this is a very challenging period for the country, we remain confident in our investments and overall strategy. We also note that history has shown (per the image below) that periods of conflict have been followed by robust recovery phases. This historical resilience, coupled with the inherent strength of the Israeli economy, reinforces our conviction in our investment approach. Whilst we cannot be sure how long this conflict will last, we have no doubts that Israel will emerge successful, and that there will be a strong rebound in both the economy and equity market.

We appreciate the trust you have placed in us, and we remain committed to transparent communication and diligent management during these testing times. We are confident that, together, we will emerge from this period with resilience and strength.

Finally, we invite you to join us for a webinar update of our portfolio and holdings which we will host at 4pm (Sydney time) on Monday 27 November. REGISTER HERE >>