SUMMARY

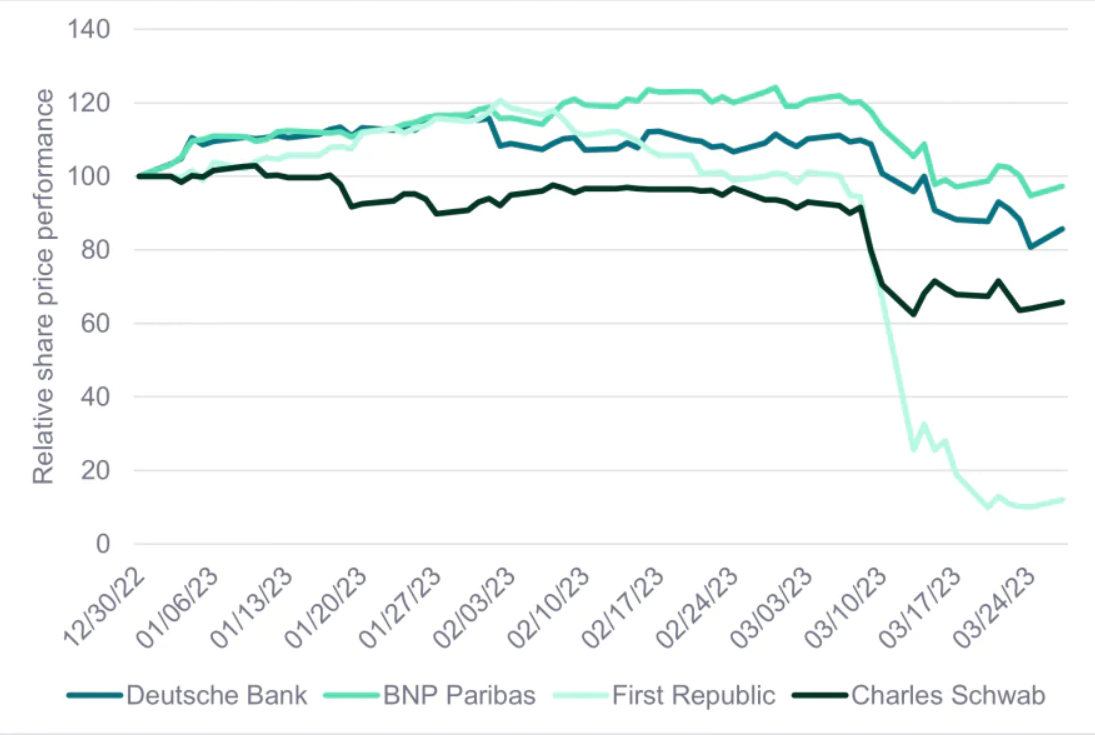

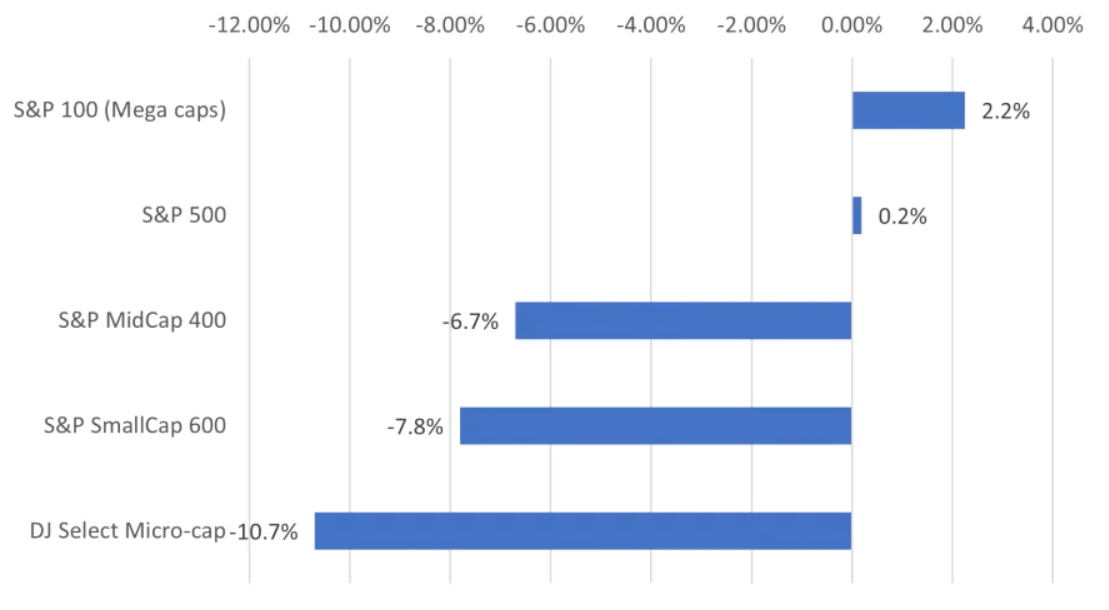

In this month’s commentary, Victoria MacLean discusses what the impact of the recent banking turmoil may mean on a longer-term basis for innovation in key areas of the economy relating to sustainability goals, including climate technology and biotechnology. Despite the uncertainty in the banking sector, the MSCI World ended the month up 3.8% and the Fund ended up 3.0%.