SUMMARY

Global Equities made a strong start to the year. Markets rallied on hopes that inflation has peaked, and that central banks are about to stabilise the pace of rate increases. The Fund delivered strong performance over January returning 5.4% (with positive contributions across all themes) and outperforming the MSCI World which returned 3.0%.

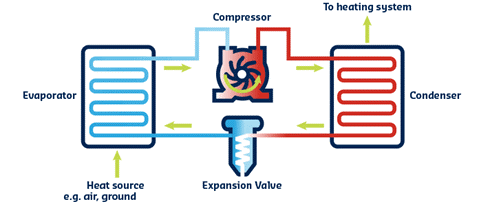

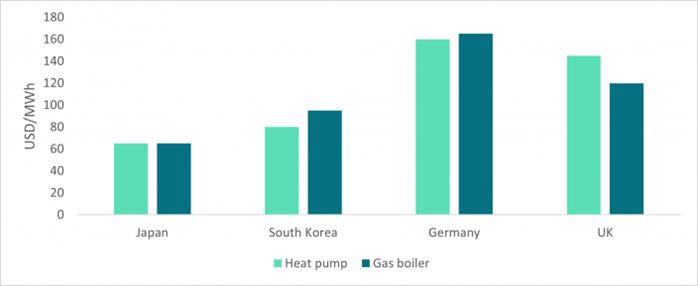

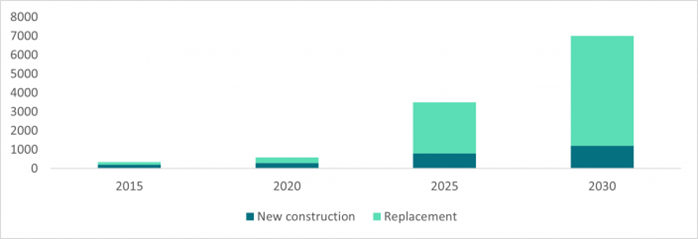

This month’s commentary discusses the rapidly expanding heat pump market. Seb Beloe (Head of Research) provides a guide to how they work, how they measure up against other heating systems and how much they cost, and the ways WHEB invests in this area.

In our recently released Quarterly Report for Q4 2022, Claire Jervis (Senior Analyst) confronts the challenge of sustainable fashion and explains how some of our holdings are providing solutions; Katie Woodhouse (Climate and Data Analyst) provides an update on WHEB’s 2022 carbon commitments and outlines our goals for 2023; and, Rachael Monteiro (Stewardship Analyst) introduces the first in a series of articles on our approach to stewardship.

Finally, we are pleased to bring you our latest company profiles document where we introduce you to the portfolio companies held in the strategy, where they sit on the impact map, and why and how they are aligned with our nine themes and the SDGs.