SUMMARY

August was a month of two halves for Global Equity markets. At the beginning of the month, investors were upbeat following a better-than-expected earnings season. This soon gave way to broader macro concerns, with equity markets selling off sharply in the latter stages of the month.

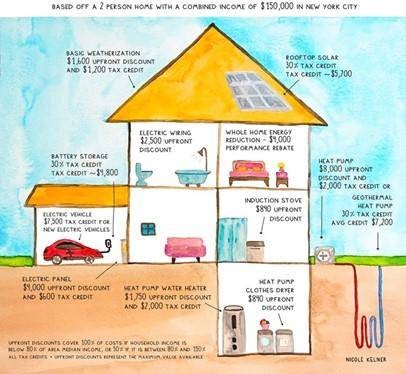

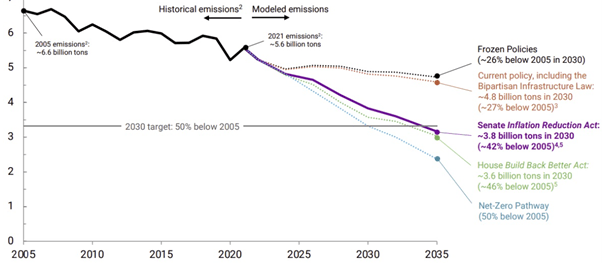

Since Richard Nixon led the world by signing the US’ Clean Air Act at the end of 1970 with bipartisan support, there have been many false dawns in the delivery of meaningful Federal policy on climate change. The consequence has been that the United States earned a reputation as a climate laggard. In this month’s commentary, Seb Beloe discusses the significance of the US’ recently passed Inflation Reduction Act with both spending provisions and tax breaks and aimed at lowering greenhouse gas (GHG) emissions and health care costs.

We are pleased to announce that Pengana has been named a Responsible Investment Leader by the Responsible Investment Association Australasia in its landmark annual Responsible Investment Benchmark Report launched this month. This recognises our commitment to responsible investing and attributes as an investment manager.