SUMMARY

The MSCI World Index was up 6.4% over the month, with the Fund strongly outperforming by returning 10.7%. Having fallen -16.0% in the first half of the year, global equity markets rebounded in July.

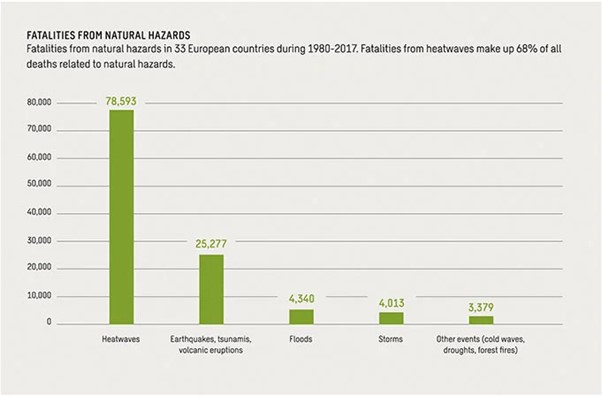

In this month’s commentary, Ty Lee discusses whether air conditioning is a solution to heatwaves given that they account for about 16% of the total electricity used in buildings globally, a figure which is set to grow dramatically in the coming years.

Earlier this year the Intergovernmental Panel on Climate Change (IPCC) published a report which concluded that the world could still stave off the worst ravages of climate change, but that this required immediate action. It may sound like hyperbole, but we are now in a time of consequences of climate change. This extreme urgency is reflected in the title of WHEB’s eighth impact report, ‘The time is now – investing in solutions to critical social and environmental challenges.’ We unpacked the latest impact report in our most recent investor webinar. Financial planners may complete a short questionnaire available HERE for CPD points.

We are pleased to announce that WHEB’s Head of Research, Seb Beloe, has been shortlisted for ‘Outstanding Contribution to the Sustainable Investment Industry’ as part of Investment Week’s Sustainable Investment Awards (UK). Our white paper, Impact Investing in Listed Equities – WHEB’s perspective, has been shortlisted for the ‘Best Sustainable Investment Thought Leadership Paper’ award.

With the growth of ESG investing and its wide range of implementations, impact investors have sought to demonstrate core elements that differentiate impact strategies from the vast range of other investment products labelled as ‘ESG’ or ‘sustainable’. One of these elements is the ‘theory of change’ that is often implicit within an impact investment strategy. Seb Beloe sets out WHEB’s theory of change in our Q2 2022 Report.

Finally, we published our profiles of our portfolio holdings as of 30 June 2022 including our assessment of the companies’ impact intensity and fundamental quality.