Russia's invasion of Ukraine continue to roil markets

PORTFOLIO

Top Holdings (alphabetically)

Sector Breakdown

Capitalisation Breakdown

Region Breakdown

PERFORMANCE

Performance Table

NET PERFORMANCE FOR PERIODS ENDING 31 Mar 20221

Performance Chart

NET PERFORMANCE SINCE INCEPTION2

COMMENTARY

March was a tough month for the strategy as some of our largest holdings were hard hit by the market, but it wasn’t all bad news.

Australian radiotherapy producer Telix fell 15% after the FDA approved Novartis’ radiotherapy drug Pluvicto for the treatment of prostate cancer. This approval was expected, however they also approved a companion diagnostic called Locametz which competes with Telix’ lead product Illucix. This clearly disappointed the market as it was not expected until year end. We view the share price fall as an overreaction and took the opportunity to buy back the Telix shares which we sold at higher prices last year. We are not overly concerned by Novartis’ entry into the prostate diagnostic market as Novartis sales force is very much focused on oncologists whereas Telix targets the larger urologist population. In addition, Telix’ major distributors in the US have strong financial incentives to market and sell Telix’ product and finally Telix has a pipeline of additional products which these distributors can sell in future which Novartis does not. Illucix, the company’s first product, a diagnostic for prostate cancer with an addressable market of AUD$1.5-$2bn commenced selling in early April. We expect a rapid ramp of sales over coming quarters which we believe will drive the shares higher. The company has a market value of AUD$1.4bn and $200mln of cash. We expect AUD$200mln-$300mln in revenue in CY2023. A second product, a diagnostic for Renal cancer should be approved in 2023 and boost growth in 2024.

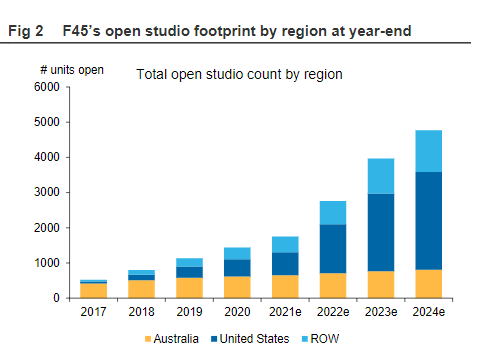

US listed gym franchise F45 and Australian listed Ardent Leisure which owns US amusement centres were down 33% and 16% respectively on little news. We continue to like the companies as they share three powerful value creation drivers. First, both have well-funded new store openings (for F45 see the figure below). Secondly, there is strong demand for their products with F45 ranked tenth on website Entrepreneurs fastest growing franchises award (https://www.entrepreneur.com/franchises/fastestgrowing) whilst Ardent has experienced phenomenal like for like growth as the concept has been reinvigorated under new management. Thirdly, both demonstrate exceptional return on capital metrics, and growth potential yet trade at a discount to peers with lower growth and returns. These two stocks generated significant outperformance in February, but this reversed in March with share prices returning to around our entry point which we struggle to reconcile with peer outperformance over this period.

F45 is trading on 10x 2023 PE with no debt which seems cheap relative to its growth profile.

On the brighter side, also on the basis of little news, the Norwegian bladder cancer diagnostic producer Photocure rose 14% although we expect strong upcoming results as cancer diagnostic procedures increase following the covid epidemic.

Australian immuno-oncology drug developer Immutep rose 11% after reporting a small study of late-stage lung cancer patients who had failed other treatments. The company will also release data on early-stage lung cancer patients at the world’s largest cancer conference ASCO in the USA in June with abstracts released in late May. It continues enrolling its Phase 2b study in Head and Neck cancer which could be used to register Efti if the results are strong, where the company has fast track approval from the FDA with interim results expected later this year and final results in mid-2023. At the time of writing Immutep has a market value of $300mln with cash of $100mln which we think is highly attractive given deals for early-stage immunotherapy assets are generally in the USD2-5bn range.

PROFILE

Platform Availability

- Hub24

- Macquarie Wrap

- Mason Stevens

- Netwealth

STATISTICAL DATA

PORTFOLIO SUMMARY

FEATURES

- APIR CODE HHA0020AU

- REDEMPTION PRICEA$ 1.01

-

FEES *

Management Fee: 1.80% p.a. (Class A) | 1.25% p.a. (Class B)

Performance Fee: 15.38% (Class A) | 20% (Class B) - Minimum initial investment A$10,000

- FUM AT MONTH END A$ 39.99m

- STRATEGY INCEPTION DATE 11 December 2014

- BenchmarkRBA Cash Rate + 3%

Fund Managers

James McDonald

Portfolio Manager

Jeremy Bendeich

Portfolio Manager

Description

The Pengana High Conviction Equities Fund (the Fund) invests globally in a concentrated portfolio of up to 20 stocks. The Fund can invest in both small and large cap stocks and is diversified across countries and sectors. We avoid investment in companies that are currently, in our opinion, unnecessarily harmful to people, animals or the environment.

EXPLORE OUR FUNDS

1. Net performance figures are shown are those of Class A Units, after all fees and expenses and assume reinvestment of distributions. No allowance has been made for buy/sell spreads. Please refer to the PDS for information regarding risks. Past performance is not a reliable indicator of future performance, the value of investments can go up and down.

2. Inception 11 December 2014.

3. Annualised standard deviation since inception.

4. Relative to MSCI World. Using daily returns.

* For further information regarding fees please see the PDS available on our website.