SUMMARY

In January the Fund rose 1.1% (both classes A & B). By comparison, the Tel Aviv Stock Exchange 125 Index fell -1.3% (in ILS).

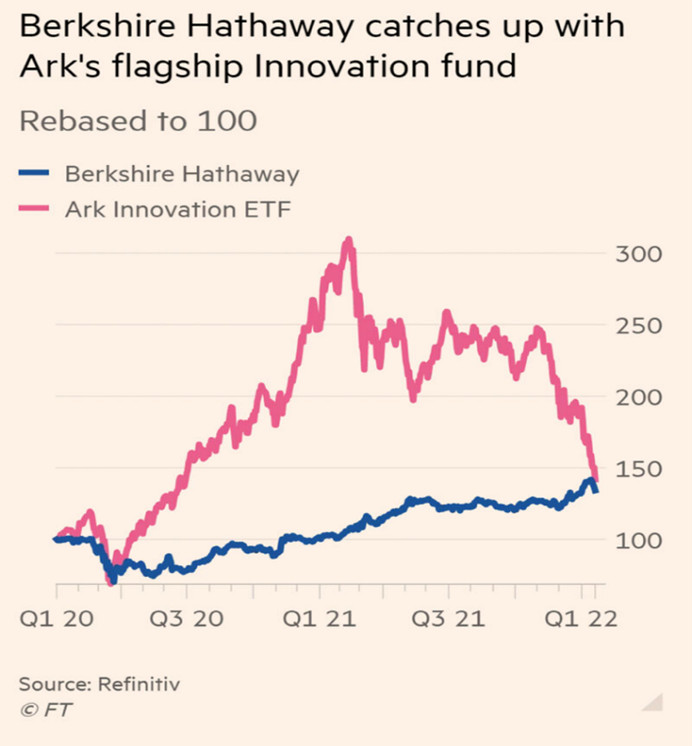

Global stock markets opened the year in a storm, the Nasdaq dropped -9%, the S&P 500 -5.3%, and Dow Jones -3.3%. “Crazy January”, as it has been called by some, also impacted the Israeli stock market, with a correction in the tech sector and broader market volatility. We were pleased to register a positive return for the Fund amidst the turmoil.

The declines occurred due to rising inflation, which reached 7% in the US by the end of the year, a level not seen in almost 40 years. As a result, investors’ expectations adjusted to the realisation that the Federal Reserve would likely raise interest rates between three and four times this year.

The month’s biggest contributors were the Fund’s holdings in Ratzio (Israel’s natural Gas exploration), which was up +17%, Fatal (Hotel chain), which was up 12%, and Kenon (see below), which was up +12%.

The main detractors in January were two of our Technology holdings on the Nasdaq, Tower Semiconductor, which was down -14%, and Nice System, which was down -16%, both due to the tech sell-off.