SUMMARY

The Fund delivered positive performance of +6.0% over the month outperforming the MSCI World Index which returned +4.1%. Our Health, Safety and Environmental Services themes performed well as did our bias to mid-cap companies.

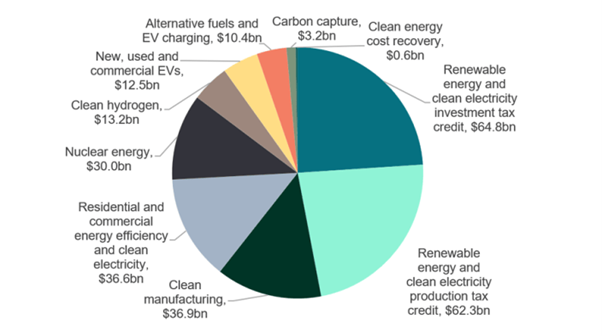

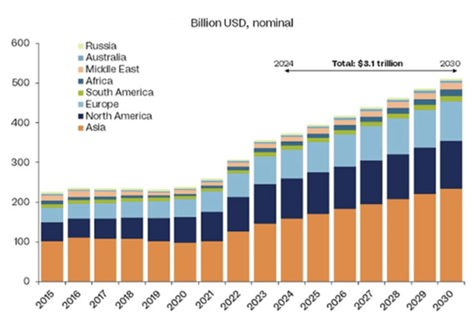

In this month’s commentary, Ty Lee discusses the renewable energy sector’s volatility in the build-up to the US election in November. He examines global developments to support the green energy transition and explains how we have adjusted our exposure to clean energy within the WHEB strategy.

WHEB joined the think tank Planet Tracker’s call on petrochemical companies to transition to safe and environmentally sound practices, by reducing fossil fuel dependency and eliminating hazardous chemicals in plastics.

We recently recorded a YTD Review and 2023 Impact Report Webinar, which is available below for your review. CPD points are applicable for Australian Financial Planners HERE.