https://data.pengana.com/wp-json/pen/performance?fund_code=PENHCT&date=28/06/2024&aggregation_code=Class%20A

Array

(

[0] => Array

(

[date] => 28/06/2024

[table] => High Conviction Equities Fund Class A

High Conviction Equities Fund Class B

[piechart] => Array

(

[0] => Array

(

[0] => Sector Breakdown

[1] => ["Consumer Discretionary", 0.024646156],["Health Care", 0.485814096],["Materials", 0.409823575],["Communication Services", 0.026414262],["Options", 0.005078639],["Cash", 0.048223271],

)

[1] => Array

(

[0] => Capitalisation Breakdown

[1] => ["Under 5bn USD", 0.94669809],["Derivatives", 0.005078639],["Cash", 0.048223271],

)

[2] => Array

(

[0] => Region Breakdown

[1] => ["North America", 0.026414262],["Australia/New Zealand", 0.920283828],["Options", 0.005078639],["Cash", 0.048223271],

)

)

[topholdings] => BRE/Brazilian Rare Earths Ltd./Australia/Materials,CU6/Clarity Pharmaceuticals Ltd/Australia/Health Care,GSS/Genetic Signatures Ltd/Australia/Health Care,IPX1/IperionX Ltd/Australia/Materials,BMHDNN9/Iperionx Ltd. Sponsored ADR/United States/Materials,

[topholdingsimg] => https://data.pengana.com/wp-content/uploads/brazilian_rare_earths_limited_logo-1.jpg,https://data.pengana.com/wp-content/uploads/clarity-pharmaceuticals-logo-2020.png,https://data.pengana.com/wp-content/uploads/Stock-Icons/genetic-signatures-logo-header.gif,https://data.pengana.com/wp-content/uploads/iperionx.png,https://data.pengana.com/wp-content/uploads/Logo_color_original_gradient.jpg,

[topholdingsintro] => Array

(

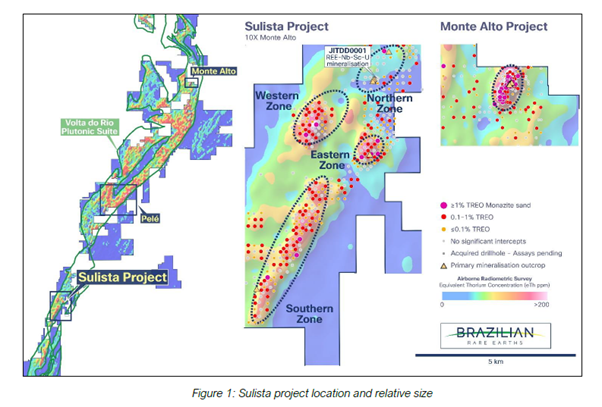

[0] => Brazilian Rare Earths Ltd. operates as a mineral exploration company. It focuses on the discovery and development of mineral resources in Brazil. The company was founded on March 3, 2021 by Bernardo da Veiga and is headquartered in Sydney, Australia.

[1] => Clarity Pharmaceuticals Limited operates as a radio-pharmaceutical company. The Company focuses on the developing targeted therapies for the treatment of cancer and other serious diseases. Clarity Pharmaceuticals serves customers worldwide.

[2] => Genetic Signatures Ltd. is a research company, which engages in the identification and commercialization of individual genetic signatures for the diagnosis of infectious diseases. It is also involved in the sale of associated products into the diagnostic and research marketplaces. Its products include the treatment for gastrointestinal infections, respiratory, sexual health, anti-microbial resistance, meningitis, and tropical disease. It operates in the following geographical segments: Asia Pacific, Europe, Middle East, and Africa (EMEA), and Americas. The company was founded by Robert J. Birrell, Christopher M. Abbott, and Geoffrey Grigg on February 15, 2001 and is headquartered in Newtown, Australia.

[3] => IperionX Ltd. engages in the development of low carbon titanium for advanced industries, including space, aerospace, electric vehicles and 3D printing. It produces titanium metal powders from titanium scrap at its operational pilot facility in Utah and intends to scale production at a Titanium Demonstration Facility in Virginia. The company was founded on May 5, 2017 and is headquartered in Charlotte, NC.

[4] => IperionX Limited focuses on sustainable mineral and material supply chains. The Company develops low carbon titanium for advanced industries including space, aerospace, electric vehicles, and 3D printing. IperionX serves customers worldwide.

[5] =>

)

[pdfchart] => PD94bWwgdmVyc2lvbj0iMS4wIiBlbmNvZGluZz0iVVRGLTgiIHN0YW5kYWxvbmU9Im5vIj8+PHN2ZyB4bWxucz0iaHR0cDovL3d3dy53My5vcmcvMjAwMC9zdmciIGJvcmRlcj0iMCIgZGF0YS1hYy13cmFwcGVyLWlkPSI2MjMiIHdpZHRoPSIzMzAiIGhlaWdodD0iMTY1IiBjbGFzcz0iYW55Y2hhcnQtdWktc3VwcG9ydCIgYWMtaWQ9ImFjX3N0YWdlX2hpIiByb2xlPSJwcmVzZW50YXRpb24iIHN0eWxlPSJkaXNwbGF5OiBibG9jazsiPjxkZWZzPjxjbGlwUGF0aCBjbGlwLXJ1bGU9Im5vbnplcm8iIGlkPSJhY19jbGlwX2kxIj48cGF0aCBkYXRhLWFjLXdyYXBwZXItaWQ9IjY0NiIgaWQ9ImFjX3JlY3RfaTIiIGZpbGw9Im5vbmUiIHN0cm9rZT0iYmxhY2siIGQ9Ik0gMCAwIEwgMjQyLjk1ODQ5NjA5Mzc1IDAgMjQyLjk1ODQ5NjA5Mzc1IDE2IDAgMTYgMCAwIFoiLz48L2NsaXBQYXRoPjxjbGlwUGF0aCBjbGlwLXJ1bGU9Im5vbnplcm8iIGlkPSJhY19jbGlwX2k5Ij48cGF0aCBkYXRhLWFjLXdyYXBwZXItaWQ9IjY1MiIgaWQ9ImFjX3JlY3RfaWEiIGZpbGw9Im5vbmUiIHN0cm9rZT0iYmxhY2siIGQ9Ik0gNTQgMjYgTCAzMjYgMjYgMzI2IDEzOCA1NCAxMzggNTQgMjYgWiIvPjwvY2xpcFBhdGg+PGNsaXBQYXRoIGNsaXAtcnVsZT0ibm9uemVybyIgaWQ9ImFjX2NsaXBfamEiPjxwYXRoIGRhdGEtYWMtd3JhcHBlci1pZD0iNjg3IiBpZD0iYWNfcmVjdF9qYiIgZmlsbD0ibm9uZSIgc3Ryb2tlPSJibGFjayIgZD0iTSA1NSAyNiBMIDMyNiAyNiAzMjYgMTM3IDU1IDEzNyA1NSAyNiBaIi8+PC9jbGlwUGF0aD48Y2xpcFBhdGggY2xpcC1ydWxlPSJub256ZXJvIiBpZD0iYWNfY2xpcF9qaCI+PHBhdGggZGF0YS1hYy13cmFwcGVyLWlkPSI2OTIiIGlkPSJhY19yZWN0X2ppIiBmaWxsPSJub25lIiBzdHJva2U9ImJsYWNrIiBkPSJNIDU1IDI2IEwgMzI2IDI2IDMyNiAxMzcgNTUgMTM3IDU1IDI2IFoiLz48L2NsaXBQYXRoPjxjbGlwUGF0aCBjbGlwLXJ1bGU9Im5vbnplcm8iIGlkPSJhY19jbGlwX2pvIj48cGF0aCBkYXRhLWFjLXdyYXBwZXItaWQ9IjY5NyIgaWQ9ImFjX3JlY3RfanAiIGZpbGw9Im5vbmUiIHN0cm9rZT0iYmxhY2siIGQ9Ik0gNTUgMjYgTCAzMjYgMjYgMzI2IDEzNyA1NSAxMzcgNTUgMjYgWiIvPjwvY2xpcFBhdGg+PGNsaXBQYXRoIGNsaXAtcnVsZT0ibm9uemVybyIgaWQ9ImFjX2NsaXBfanciPjxwYXRoIGRhdGEtYWMtd3JhcHBlci1pZD0iNzAzIiBpZD0iYWNfcmVjdF9qeCIgZmlsbD0ibm9uZSIgc3Ryb2tlPSJibGFjayIgZD0iTSA1NCAyNiBMIDMyNSAyNiAzMjUgMTM3IDU0IDEzNyA1NCAyNiBaIi8+PC9jbGlwUGF0aD48L2RlZnM+PGcgZGF0YS1hYy13cmFwcGVyLWlkPSI2MjQiIGlkPSJhY19sYXllcl9oaiI+PGcgZGF0YS1hYy13cmFwcGVyLWlkPSI2MjkiIHJvbGU9ImFydGljbGUiIGFyaWEtbGFiZWw9ImxpbmUgY2hhcnQgLCB3aXRoIDMgbGluZSBzZXJpZXMsIC4gWS1zY2FsZSBtaW5pbXVtIHZhbHVlIGlzIDAgLCBtYXhpbXVtIHZhbHVlIGlzIDEwMDAwMDAuIFgtc2NhbGUgd2l0aCAxMTYgY2F0ZWdvcmllczogMzAvMTEvMjAxNCwgMzEvMTIvMjAxNCwgMzAvMDEvMjAxNSwgMjcvMDIvMjAxNSwgMzEvMDMvMjAxNSwgMzAvMDQvMjAxNSwgMjkvMDUvMjAxNSwgMzAvMDYvMjAxNSwgMzEvMDcvMjAxNSwgMzEvMDgvMjAxNSwgMzAvMDkvMjAxNSwgMzAvMTAvMjAxNSwgMzAvMTEvMjAxNSwgMzEvMTIvMjAxNSwgMjkvMDEvMjAxNiwgMjkvMDIvMjAxNiwgMzEvMDMvMjAxNiwgMjkvMDQvMjAxNiwgMzEvMDUvMjAxNiwgMzAvMDYvMjAxNiwgMjkvMDcvMjAxNiwgMzEvMDgvMjAxNiwgMzAvMDkvMjAxNiwgMzEvMTAvMjAxNiwgMzAvMTEvMjAxNiwgMzAvMTIvMjAxNiwgMzEvMDEvMjAxNywgMjgvMDIvMjAxNywgMzEvMDMvMjAxNywgMjgvMDQvMjAxNywgMzEvMDUvMjAxNywgMzAvMDYvMjAxNywgMzEvMDcvMjAxNywgMzEvMDgvMjAxNywgMjkvMDkvMjAxNywgMzEvMTAvMjAxNywgMzAvMTEvMjAxNywgMjkvMTIvMjAxNywgMzEvMDEvMjAxOCwgMjgvMDIvMjAxOCwgMjkvMDMvMjAxOCwgMzAvMDQvMjAxOCwgMzEvMDUvMjAxOCwgMjkvMDYvMjAxOCwgMzEvMDcvMjAxOCwgMzEvMDgvMjAxOCwgMjgvMDkvMjAxOCwgMzEvMTAvMjAxOCwgMzAvMTEvMjAxOCwgMzEvMTIvMjAxOCwgMzEvMDEvMjAxOSwgMjgvMDIvMjAxOSwgMjkvMDMvMjAxOSwgMzAvMDQvMjAxOSwgMzEvMDUvMjAxOSwgMjgvMDYvMjAxOSwgMzEvMDcvMjAxOSwgMzAvMDgvMjAxOSwgMzAvMDkvMjAxOSwgMzEvMTAvMjAxOSwgMjkvMTEvMjAxOSwgMzEvMTIvMjAxOSwgMzEvMDEvMjAyMCwgMjgvMDIvMjAyMCwgMzEvMDMvMjAyMCwgMzAvMDQvMjAyMCwgMjkvMDUvMjAyMCwgMzAvMDYvMjAyMCwgMzEvMDcvMjAyMCwgMzEvMDgvMjAyMCwgMzAvMDkvMjAyMCwgMzAvMTAvMjAyMCwgMzAvMTEvMjAyMCwgMzEvMTIvMjAyMCwgMjkvMDEvMjAyMSwgMjYvMDIvMjAyMSwgMzEvMDMvMjAyMSwgMzAvMDQvMjAyMSwgMzEvMDUvMjAyMSwgMzAvMDYvMjAyMSwgMzAvMDcvMjAyMSwgMzEvMDgvMjAyMSwgMzAvMDkvMjAyMSwgMjkvMTAvMjAyMSwgMzAvMTEvMjAyMSwgMzEvMTIvMjAyMSwgMzEvMDEvMjAyMiwgMjgvMDIvMjAyMiwgMzEvMDMvMjAyMiwgMjkvMDQvMjAyMiwgMzEvMDUvMjAyMiwgMzAvMDYvMjAyMiwgMjkvMDcvMjAyMiwgMzEvMDgvMjAyMiwgMzAvMDkvMjAyMiwgMzEvMTAvMjAyMiwgMzAvMTEvMjAyMiwgMzAvMTIvMjAyMiwgMzEvMDEvMjAyMywgMjgvMDIvMjAyMywgMzEvMDMvMjAyMywgMjgvMDQvMjAyMywgMzEvMDUvMjAyMywgMzAvMDYvMjAyMywgMzEvMDcvMjAyMywgMzEvMDgvMjAyMywgMjkvMDkvMjAyMywgMzEvMTAvMjAyMywgMzAvMTEvMjAyMywgMjkvMTIvMjAyMywgMzEvMDEvMjAyNCwgMjkvMDIvMjAyNCwgMjgvMDMvMjAyNCwgMzAvMDQvMjAyNCwgMzEvMDUvMjAyNCwgMjgvMDYvMjAyNCwgLiAiIGlkPSJhY19jaGFydF9oayI+PGcgZGF0YS1hYy13cmFwcGVyLWlkPSI2MzAiIGlkPSJhY19sYXllcl9obSI+PHBhdGggZGF0YS1hYy13cmFwcGVyLWlkPSI2MzEiIGlkPSJhY19wYXRoX2hsIiBmaWxsPSIjRUFFQUVBIiBzdHJva2U9Im5vbmUiIGQ9Ik0gMCAwIEwgMzMwIDAgMzMwIDAgMzMwIDE2NSAzMzAgMTY1IDAgMTY1IDAgMTY1IDAgMCAwIDAgWiIvPjwvZz48cGF0aCBkYXRhLWFjLXdyYXBwZXItaWQ9IjcwMiIgY2xpcC1wYXRoPSJ1cmwoJnF1b3Q7I2FjX2NsaXBfancmcXVvdDspIiBjbGlwUGF0aFVuaXRzPSJ1c2VyU3BhY2VPblVzZSIgaWQ9ImFjX3BhdGhfankiIGZpbGw9Im5vbmUiIHN0cm9rZT0ibm9uZSIgZD0iTSAwLDAiLz48cGF0aCBkYXRhLWFjLXdyYXBwZXItaWQ9IjY0NyIgaWQ9ImFjX3BhdGhfaTQiIGZpbGw9Im5vbmUiIHN0cm9rZT0ibm9uZSIgZD0iTSA1NCAxMzcuNSBMIDMyNSAxMzcuNSAzMjUgMTA5LjUgNTQgMTA5LjUgWiIvPjxwYXRoIGRhdGEtYWMtd3JhcHBlci1pZD0iNjQ4IiBpZD0iYWNfcGF0aF9pNSIgZmlsbD0ibm9uZSIgc3Ryb2tlPSJub25lIiBkPSJNIDU0IDEwOS41IEwgMzI1IDEwOS41IDMyNSA4MS41IDU0IDgxLjUgWiIvPjxwYXRoIGRhdGEtYWMtd3JhcHBlci1pZD0iNjQ5IiBpZD0iYWNfcGF0aF9pNiIgZmlsbD0ibm9uZSIgc3Ryb2tlPSJub25lIiBkPSJNIDU0IDgxLjUgTCAzMjUgODEuNSAzMjUgNTMuNSA1NCA1My41IFoiLz48cGF0aCBkYXRhLWFjLXdyYXBwZXItaWQ9IjY1MCIgaWQ9ImFjX3BhdGhfaTciIGZpbGw9Im5vbmUiIHN0cm9rZT0ibm9uZSIgZD0iTSA1NCA1My41IEwgMzI1IDUzLjUgMzI1IDI2LjUgNTQgMjYuNSBaIi8+PHBhdGggZGF0YS1hYy13cmFwcGVyLWlkPSI2NTEiIGNsaXAtcGF0aD0idXJsKCZxdW90OyNhY19jbGlwX2k5JnF1b3Q7KSIgY2xpcFBhdGhVbml0cz0idXNlclNwYWNlT25Vc2UiIGlkPSJhY19wYXRoX2liIiBmaWxsPSJub25lIiBzdHJva2U9IiNDRUNFQ0UiIGQ9Ik0gNTQgMTM3LjUgTCAzMjUgMTM3LjUgTSA1NCAxMDkuNSBMIDMyNSAxMDkuNSBNIDU0IDgxLjUgTCAzMjUgODEuNSBNIDU0IDUzLjUgTCAzMjUgNTMuNSBNIDU0IDI2LjUgTCAzMjUgMjYuNSIvPjxnIGRhdGEtYWMtd3JhcHBlci1pZD0iNjk1IiBjbGlwLXBhdGg9InVybCgmcXVvdDsjYWNfY2xpcF9qbyZxdW90OykiIGNsaXBQYXRoVW5pdHM9InVzZXJTcGFjZU9uVXNlIiBpZD0iYWNfbGF5ZXJfanEiPjxwYXRoIGRhdGEtYWMtd3JhcHBlci1pZD0iNjk2IiBpZD0iYWNfcGF0aF9qbSIgZmlsbD0ibm9uZSIgc3Ryb2tlPSIjNjEyMTQxIiBzdHJva2Utd2lkdGg9IjEiIGQ9Ik0gNTQgMTI1LjkgTCA1Ni4zNTY1MjE3MzkxMzA0MzYgMTI1Ljg0MjI4IDU4LjcxMzA0MzQ3ODI2MDg3IDEyNC40MjcwMyA2MS4wNjk1NjUyMTczOTEzIDEyNC4xNzI4NDAwMDAwMDAwMSA2My40MjYwODY5NTY1MjE3NCAxMjMuODQ3NjEgNjUuNzgyNjA4Njk1NjUyMTcgMTIxLjg4MjkxIDY4LjEzOTEzMDQzNDc4MjYgMTIwLjYyODYxIDcwLjQ5NTY1MjE3MzkxMzA0IDExOS41MjQxNiA3Mi44NTIxNzM5MTMwNDM0OSAxMjEuMzUwMTEgNzUuMjA4Njk1NjUyMTczOTIgMTIxLjA3ODE2IDc3LjU2NTIxNzM5MTMwNDM0IDExNi43NzM1OCA3OS45MjE3MzkxMzA0MzQ3OSAxMTMuODE5ODcwMDAwMDAwMDEgODIuMjc4MjYwODY5NTY1MjIgMTE2Ljc2NTgxIDg0LjYzNDc4MjYwODY5NTY0IDExMy4xNzk0IDg2Ljk5MTMwNDM0NzgyNjA5IDExMy4xOTM4MyA4OS4zNDc4MjYwODY5NTY1MyAxMDcuNjgyNjggOTEuNzA0MzQ3ODI2MDg2OTYgMTA4LjEwNDQ4IDk0LjA2MDg2OTU2NTIxNzM5IDEwNS45MDY2OCA5Ni40MTczOTEzMDQzNDc4MyAxMDIuNDU0NTc5OTk5OTk5OTkgOTguNzczOTEzMDQzNDc4MjYgOTguMzIwMjc0IDEwMS4xMzA0MzQ3ODI2MDg3IDk0Ljg5MDI2MyAxMDMuNDg2OTU2NTIxNzM5MTMgOTcuMTUyMTEgMTA1Ljg0MzQ3ODI2MDg2OTU3IDk2LjEzNjc5MzAwMDAwMDAxIDEwOC4yMDAwMDAwMDAwMDAwMiA5Ny42OTMxMjQwMDAwMDAwMSAxMTAuNTU2NTIxNzM5MTMwNDMgOTguOTg1Mjc1IDExMi45MTMwNDM0NzgyNjA4NyAxMDIuNzM2NDA5MDAwMDAwMDEgMTE1LjI2OTU2NTIxNzM5MTMgOTkuNTEzNzQ2IDExNy42MjYwODY5NTY1MjE3MyA5OS4xMDkyNjIgMTE5Ljk4MjYwODY5NTY1MjE5IDk4LjQxNjI4OSAxMjIuMzM5MTMwNDM0NzgyNiA5OS4xNzYxOTUgMTI0LjY5NTY1MjE3MzkxMzA1IDEwMi4xNDc3NzYgMTI3LjA1MjE3MzkxMzA0MzQ2IDEwMS44MDM2NzYgMTI5LjQwODY5NTY1MjE3MzkyIDEwMy4zNDQyNDUgMTMxLjc2NTIxNzM5MTMwNDM2IDEwMi43NTc0OTkgMTM0LjEyMTczOTEzMDQzNDc4IDk5Ljg0MDY0MSAxMzYuNDc4MjYwODY5NTY1MjIgOTcuMTI3OTEyIDEzOC44MzQ3ODI2MDg2OTU2NiA5Ni45MTI3OTM5OTk5OTk5OSAxNDEuMTkxMzA0MzQ3ODI2MDggOTcuNTU4MTQ4IDE0My41NDc4MjYwODY5NTY1MiA5Ny4yOTI0MTQwMDAwMDAwMSAxNDUuOTA0MzQ3ODI2MDg2OTYgOTYuODc0ODMyIDE0OC4yNjA4Njk1NjUyMTczOCA5Ni44NDc4NTkgMTUwLjYxNzM5MTMwNDM0NzggOTYuNzE4MjExIDE1Mi45NzM5MTMwNDM0NzgyNiA5Ny4xNDM2NzQgMTU1LjMzMDQzNDc4MjYwODY4IDk1LjMxMzUwNTk5OTk5OTk5IDE1Ny42ODY5NTY1MjE3MzkxMiA5NC4zNDY1ODUgMTYwLjA0MzQ3ODI2MDg2OTU2IDg4LjQwNzk3NCAxNjIuNCA4OS40Nzg2OCAxNjQuNzU2NTIxNzM5MTMwNCA5My4xOTI5NjIgMTY3LjExMzA0MzQ3ODI2MDg2IDk0Ljk1NjY0MDk5OTk5OTk5IDE2OS40Njk1NjUyMTczOTEzIDk0Ljc1MTI5MTAwMDAwMDAxIDE3MS44MjYwODY5NTY1MjE3MiA5My44MDA5MDg5OTk5OTk5OSAxNzQuMTgyNjA4Njk1NjUyMTYgOTIuNjM2ODUyIDE3Ni41MzkxMzA0MzQ3ODI2IDkxLjI1OTAwOSAxNzguODk1NjUyMTczOTEzMDUgODkuMDQzMDA1IDE4MS4yNTIxNzM5MTMwNDM0NiA5Mi42MDU2NjEgMTgzLjYwODY5NTY1MjE3MzkgOTAuNTM0ODQ0OTk5OTk5OTkgMTg1Ljk2NTIxNzM5MTMwNDM1IDg2LjU1NTI3MyAxODguMzIxNzM5MTMwNDM0NzYgODYuNDY0MzYzOTk5OTk5OTkgMTkwLjY3ODI2MDg2OTU2NTIgODcuMzAwMTk0IDE5My4wMzQ3ODI2MDg2OTU2MiA4Ny40MjQyOTIgMTk1LjM5MTMwNDM0NzgyNjEgODMuNjk1MjQ3IDE5Ny43NDc4MjYwODY5NTY1NCA4My41NjIyNjkgMjAwLjEwNDM0NzgyNjA4NjkyIDgzLjEwNTUwNCAyMDIuNDYwODY5NTY1MjE3MzcgODQuNzk5MzY0IDIwNC44MTczOTEzMDQzNDc4NCA5NC4wMTc5MTM5OTk5OTk5OSAyMDcuMTczOTEzMDQzNDc4MjIgODkuMTQyNTcyIDIwOS41MzA0MzQ3ODI2MDg3IDg2LjE0NzM0OCAyMTEuODg2OTU2NTIxNzM5MSA4Ny42NDE2Mjk5OTk5OTk5OSAyMTQuMjQzNDc4MjYwODY5NTUgODUuNDU3MzcxOTk5OTk5OTkgMjE2LjYgODMuMzc0MTI0IDIxOC45NTY1MjE3MzkxMzA0NCA4NC41NTgwNTAwMDAwMDAwMSAyMjEuMzEzMDQzNDc4MjYwODIgODQuNTgzMjQ3IDIyMy42Njk1NjUyMTczOTEzMiA3Ny41MDc0NDEgMjI2LjAyNjA4Njk1NjUyMTc0IDczLjc2OTk2IDIyOC4zODI2MDg2OTU2NTIxNSA3MS4zMzEwNjggMjMwLjczOTEzMDQzNDc4MjYyIDcxLjYwODY3OSAyMzMuMDk1NjUyMTczOTEzMDQgNjguNjI1OTk4IDIzNS40NTIxNzM5MTMwNDM0OCA2OS4yOTEzMzIgMjM3LjgwODY5NTY1MjE3MzkgNjkuNjQ2OTc2IDI0MC4xNjUyMTczOTEzMDQzNyA2NS45MDk0OTUgMjQyLjUyMTczOTEzMDQzNDc4IDY4LjQ4MTE0MyAyNDQuODc4MjYwODY5NTY1MjIgNjYuMDEwOTQ5IDI0Ny4yMzQ3ODI2MDg2OTU2NCA2OC4xMjg2MDcgMjQ5LjU5MTMwNDM0NzgyNjEgNjkuOTg1NTI2MDAwMDAwMDEgMjUxLjk0NzgyNjA4Njk1NjUyIDcwLjY2MTYyNyAyNTQuMzA0MzQ3ODI2MDg2OTQgNjcuOTU5NTU0IDI1Ni42NjA4Njk1NjUyMTczNSA3MS4zNzE0NzIgMjU5LjAxNzM5MTMwNDM0NzggNzQuMDcxMTAzMDAwMDAwMDEgMjYxLjM3MzkxMzA0MzQ3ODMgNzkuMDc5MjAxMDAwMDAwMDEgMjYzLjczMDQzNDc4MjYwODY1IDc5LjYzNjk3NiAyNjYuMDg2OTU2NTIxNzM5MSA4Mi4zMjY4MzkgMjY4LjQ0MzQ3ODI2MDg2OTYgODYuMDc0NDIxIDI3MC44IDgxLjgyNzAwNiAyNzMuMTU2NTIxNzM5MTMwNCA4My43ODUzNzkgMjc1LjUxMzA0MzQ3ODI2MDggODguNjk5MjM4MDAwMDAwMDEgMjc3Ljg2OTU2NTIxNzM5MTMgODQuNTk2Njc4IDI4MC4yMjYwODY5NTY1MjE3IDgzLjE2NDc3OCAyODIuNTgyNjA4Njk1NjUyMTQgODMuNzc4MTY0IDI4NC45MzkxMzA0MzQ3ODI2IDgxLjAxMDkzMzk5OTk5OTk5IDI4Ny4yOTU2NTIxNzM5MTMgODEuNTMwMDgxIDI4OS42NTIxNzM5MTMwNDM0NCA4Mi4yNDIzNjggMjkyLjAwODY5NTY1MjE3MzkgNzguNjAxMDEzMDAwMDAwMDEgMjk0LjM2NTIxNzM5MTMwNDMgNzguNjk3NTgzIDI5Ni43MjE3MzkxMzA0MzQ4IDc4LjU4MTY5OTAwMDAwMDAxIDI5OS4wNzgyNjA4Njk1NjUyIDc5LjY0NzE4OCAzMDEuNDM0NzgyNjA4Njk1NiA3OS44NzcyOTA5OTk5OTk5OSAzMDMuNzkxMzA0MzQ3ODI2MSA3OS43MTI1NjcgMzA2LjE0NzgyNjA4Njk1NjUgODQuMjQ1ODA3IDMwOC41MDQzNDc4MjYwODY5IDc4LjUwNjY2MyAzMTAuODYwODY5NTY1MjE3NCA3Mi44MzUzNCAzMTMuMjE3MzkxMzA0MzQ3OCA2Ni43NzQwNzQgMzE1LjU3MzkxMzA0MzQ3ODIgNTMuMDI5MTY2MDAwMDAwMDA0IDMxNy45MzA0MzQ3ODI2MDg3IDUyLjI0MjE3NiAzMjAuMjg2OTU2NTIxNzM5MSA1MS44OTEwODMwMDAwMDAwMSAzMjIuNjQzNDc4MjYwODY5NiAzNy4zMTA2NzgwMDAwMDAwMSAzMjUgNDYuMDA0MTk4Ii8+PC9nPjxnIGRhdGEtYWMtd3JhcHBlci1pZD0iNjkwIiBjbGlwLXBhdGg9InVybCgmcXVvdDsjYWNfY2xpcF9qaCZxdW90OykiIGNsaXBQYXRoVW5pdHM9InVzZXJTcGFjZU9uVXNlIiBpZD0iYWNfbGF5ZXJfamoiPjxwYXRoIGRhdGEtYWMtd3JhcHBlci1pZD0iNjkxIiBpZD0iYWNfcGF0aF9qZiIgZmlsbD0ibm9uZSIgc3Ryb2tlPSIjNWY1ZjVmIiBzdHJva2Utd2lkdGg9IjEiIGQ9Ik0gNTQgMTI1LjkgTCA1Ni4zNTY1MjE3MzkxMzA0MzYgMTI1LjcyODk0OSA1OC43MTMwNDM0NzgyNjA4NyAxMjUuMzcwNDE5IDYxLjA2OTU2NTIxNzM5MTMgMTI0Ljc1MTkyNyA2My40MjYwODY5NTY1MjE3NCAxMjQuNjQ2OTIxIDY1Ljc4MjYwODY5NTY1MjE3IDEyNC43NTQ4MTMgNjguMTM5MTMwNDM0NzgyNiAxMjQuMzM4NTYzIDcwLjQ5NTY1MjE3MzkxMzA0IDEyNC42ODM2NjIgNzIuODUyMTczOTEzMDQzNDkgMTIzLjg3NzgwMiA3NS4yMDg2OTU2NTIxNzM5MiAxMjQuMzA3MTUwMDAwMDAwMDEgNzcuNTY1MjE3MzkxMzA0MzQgMTI0LjY1ODY4NyA3OS45MjE3MzkxMzA0MzQ3OSAxMjMuODg5NzkgODIuMjc4MjYwODY5NTY1MjIgMTI0LjE1NTc0NiA4NC42MzQ3ODI2MDg2OTU2NCAxMjQuNDMyNjkxIDg2Ljk5MTMwNDM0NzgyNjA5IDEyNC44NDcxNjUgODkuMzQ3ODI2MDg2OTU2NTMgMTI1LjA1NDA2OSA5MS43MDQzNDc4MjYwODY5NiAxMjUuMTU1NTIzIDk0LjA2MDg2OTU2NTIxNzM5IDEyNC44NzE5MTggOTYuNDE3MzkxMzA0MzQ3ODMgMTI0LjE1MjMwNSA5OC43NzM5MTMwNDM0NzgyNiAxMjQuNjQwMDM5IDEwMS4xMzA0MzQ3ODI2MDg3IDEyNC4zNzk3NDQgMTAzLjQ4Njk1NjUyMTczOTEzIDEyNC4xODM2MDcgMTA1Ljg0MzQ3ODI2MDg2OTU3IDEyNC4zNDYxMTEwMDAwMDAwMSAxMDguMjAwMDAwMDAwMDAwMDIgMTI0LjUyMDkzNiAxMTAuNTU2NTIxNzM5MTMwNDMgMTIzLjk2MjgyOCAxMTIuOTEzMDQzNDc4MjYwODcgMTIzLjM3ODk2OCAxMTUuMjY5NTY1MjE3MzkxMyAxMjMuNjk0MzE5MDAwMDAwMDEgMTE3LjYyNjA4Njk1NjUyMTczIDEyMy40OTc2MjcgMTE5Ljk4MjYwODY5NTY1MjE5IDEyMy4yNDY1NDUgMTIyLjMzOTEzMDQzNDc4MjYgMTIyLjc2MjkxOCAxMjQuNjk1NjUyMTczOTEzMDUgMTIyLjM5NTM5NyAxMjcuMDUyMTczOTEzMDQzNDYgMTIyLjc3MTEzMiAxMjkuNDA4Njk1NjUyMTczOTIgMTIzLjAwMTc5IDEzMS43NjUyMTczOTEzMDQzNiAxMjIuODkwMjM1IDEzNC4xMjE3MzkxMzA0MzQ3OCAxMjIuNDE3MjY0IDEzNi40NzgyNjA4Njk1NjUyMiAxMjEuNzk0Nzc2IDEzOC44MzQ3ODI2MDg2OTU2NiAxMjEuMzA5ODE3IDE0MS4xOTEzMDQzNDc4MjYwOCAxMjEuNTY1MjI4IDE0My41NDc4MjYwODY5NTY1MiAxMjEuMzA0MTU2IDE0NS45MDQzNDc4MjYwODY5NiAxMjEuMzY1NDI4IDE0OC4yNjA4Njk1NjUyMTczOCAxMjEuNDYyOTk3IDE1MC42MTczOTEzMDQzNDc4IDEyMS4wMzA0MyAxNTIuOTczOTEzMDQzNDc4MjYgMTIwLjk2ODYwMyAxNTUuMzMwNDM0NzgyNjA4NjggMTIwLjU5MDIwNCAxNTcuNjg2OTU2NTIxNzM5MTIgMTIwLjE4MTI4IDE2MC4wNDM0NzgyNjA4Njk1NiAxMTkuNDk3NjMxIDE2Mi40IDExOS40MDg2MDkgMTY0Ljc1NjUyMTczOTEzMDQgMTIwLjM1OTk5IDE2Ny4xMTMwNDM0NzgyNjA4NiAxMjAuNjY2NDYxIDE2OS40Njk1NjUyMTczOTEzIDEyMS4zNDU2NyAxNzEuODI2MDg2OTU2NTIxNzIgMTIwLjcwOTY0MDAwMDAwMDAxIDE3NC4xODI2MDg2OTU2NTIxNiAxMTkuODAyMzI2IDE3Ni41MzkxMzA0MzQ3ODI2IDExOS41NDk0NjggMTc4Ljg5NTY1MjE3MzkxMzA1IDExOC43NjM4MSAxODEuMjUyMTczOTEzMDQzNDYgMTE5LjU0MzI1MiAxODMuNjA4Njk1NjUyMTczOSAxMTguNjI4OTQ1IDE4NS45NjUyMTczOTEzMDQzNSAxMTguMjAzMDM3OTk5OTk5OTkgMTg4LjMyMTczOTEzMDQzNDc2IDExOC4xNjM5NjYgMTkwLjY3ODI2MDg2OTU2NTIgMTE3Ljc4MzEyNSAxOTMuMDM0NzgyNjA4Njk1NjIgMTE3LjcwODg2NiAxOTUuMzkxMzA0MzQ3ODI2MSAxMTYuODAzNjYxIDE5Ny43NDc4MjYwODY5NTY1NCAxMTYuOTg0MjU4IDIwMC4xMDQzNDc4MjYwODY5MiAxMTYuMTEwNTc3IDIwMi40NjA4Njk1NjUyMTczNyAxMTcuMTQzNjU0IDIwNC44MTczOTEzMDQzNDc4NCAxMTguODUxMDU2IDIwNy4xNzM5MTMwNDM0NzgyMiAxMTguMTc5ODM5IDIwOS41MzA0MzQ3ODI2MDg3IDExNy41NDExNDUgMjExLjg4Njk1NjUyMTczOTEgMTE3Ljc0Mjk0MyAyMTQuMjQzNDc4MjYwODY5NTUgMTE3LjYyNzgzNiAyMTYuNiAxMTYuOTU5Mzk0IDIxOC45NTY1MjE3MzkxMzA0NCAxMTcuMDM1MzE4IDIyMS4zMTMwNDM0NzgyNjA4MiAxMTcuMjQ4MTA1MDAwMDAwMDEgMjIzLjY2OTU2NTIxNzM5MTMyIDExNS43Njg2OTcgMjI2LjAyNjA4Njk1NjUyMTc0IDExNS45MzcxOTUgMjI4LjM4MjYwODY5NTY1MjE1IDExNi4wMjY5OTQgMjMwLjczOTEzMDQzNDc4MjYyIDExNS42ODI2NzIgMjMzLjA5NTY1MjE3MzkxMzA0IDExNC42MTA0MTIgMjM1LjQ1MjE3MzkxMzA0MzQ4IDExMy44OTYwMTYgMjM3LjgwODY5NTY1MjE3MzkgMTEzLjYxMTYzNCAyNDAuMTY1MjE3MzkxMzA0MzcgMTEyLjUyNjI3NiAyNDIuNTIxNzM5MTMwNDM0NzggMTExLjU1NTgwMyAyNDQuODc4MjYwODY5NTY1MjIgMTEwLjc3MjY5OCAyNDcuMjM0NzgyNjA4Njk1NjQgMTExLjU2NTkwNCAyNDkuNTkxMzA0MzQ3ODI2MSAxMTEuMTUzOTgzIDI1MS45NDc4MjYwODY5NTY1MiAxMTAuMjIxMTM5IDI1NC4zMDQzNDc4MjYwODY5NCAxMDkuNzY3OTI2IDI1Ni42NjA4Njk1NjUyMTczNSAxMTAuMzg1MTk3IDI1OS4wMTczOTEzMDQzNDc4IDExMS44MTI1NDYgMjYxLjM3MzkxMzA0MzQ3ODMgMTExLjk5MzI1NDAwMDAwMDAxIDI2My43MzA0MzQ3ODI2MDg2NSAxMTIuNzcwMzY1IDI2Ni4wODY5NTY1MjE3MzkxIDExMi45Nzg0OSAyNjguNDQzNDc4MjYwODY5NiAxMTQuMTExNTc4MDAwMDAwMDEgMjcwLjggMTEyLjY1MzcwNCAyNzMuMTU2NTIxNzM5MTMwNCAxMTMuMjU0NzY5IDI3NS41MTMwNDM0NzgyNjA4IDExNC4wMzUwOTkgMjc3Ljg2OTU2NTIxNzM5MTMgMTEyLjI1MTEwNyAyODAuMjI2MDg2OTU2NTIxNyAxMTEuNzI1OTY2IDI4Mi41ODI2MDg2OTU2NTIxNCAxMTMuMTAwODEyIDI4NC45MzkxMzA0MzQ3ODI2IDExMi4zNzIyMDggMjg3LjI5NTY1MjE3MzkxMyAxMTEuODg0MjUyIDI4OS42NTIxNzM5MTMwNDM0NCAxMTAuOTMwMzE4IDI5Mi4wMDg2OTU2NTIxNzM5IDExMC4xMTYxMzMgMjk0LjM2NTIxNzM5MTMwNDMgMTA5LjgyMTA5NSAyOTYuNzIxNzM5MTMwNDM0OCAxMDguOTc4MzgzMDAwMDAwMDEgMjk5LjA3ODI2MDg2OTU2NTIgMTA4LjM4OTUyOCAzMDEuNDM0NzgyNjA4Njk1NiAxMDcuOTQzMDg2IDMwMy43OTEzMDQzNDc4MjYxIDEwOS4wOTk3MDYgMzA2LjE0NzgyNjA4Njk1NjUgMTA5LjM4NTA4NyAzMDguNTA0MzQ3ODI2MDg2OSAxMDguMTU4MjA0IDMxMC44NjA4Njk1NjUyMTc0IDEwNy41OTc5ODcgMzEzLjIxNzM5MTMwNDM0NzggMTA2LjI4NjQxMSAzMTUuNTczOTEzMDQzNDc4MiAxMDQuNDk3NTM1IDMxNy45MzA0MzQ3ODI2MDg3IDEwMy41MjY4Mzk5OTk5OTk5OSAzMjAuMjg2OTU2NTIxNzM5MSAxMDQuNjA5NTM0IDMyMi42NDM0NzgyNjA4Njk2IDEwMy45NjIwNzEwMDAwMDAwMSAzMjUgMTAzLjQzMTE1OCIvPjwvZz48ZyBkYXRhLWFjLXdyYXBwZXItaWQ9IjY5OCIgY2xpcC1wYXRoPSJ1cmwoJnF1b3Q7I2FjX2NsaXBfam8mcXVvdDspIiBjbGlwUGF0aFVuaXRzPSJ1c2VyU3BhY2VPblVzZSIgaWQ9ImFjX2xheWVyX2pyIi8+PGcgZGF0YS1hYy13cmFwcGVyLWlkPSI2OTkiIGNsaXAtcGF0aD0idXJsKCZxdW90OyNhY19jbGlwX2pvJnF1b3Q7KSIgY2xpcFBhdGhVbml0cz0idXNlclNwYWNlT25Vc2UiIGlkPSJhY19sYXllcl9qcyIvPjxnIGRhdGEtYWMtd3JhcHBlci1pZD0iNjg1IiBjbGlwLXBhdGg9InVybCgmcXVvdDsjYWNfY2xpcF9qYSZxdW90OykiIGNsaXBQYXRoVW5pdHM9InVzZXJTcGFjZU9uVXNlIiBpZD0iYWNfbGF5ZXJfamMiPjxwYXRoIGRhdGEtYWMtd3JhcHBlci1pZD0iNjg2IiBpZD0iYWNfcGF0aF9qOCIgZmlsbD0ibm9uZSIgc3Ryb2tlPSIjYTNhM2EzIiBzdHJva2Utd2lkdGg9IjEiIGQ9Ik0gNTQgMTI1LjkgTCA1Ni4zNTY1MjE3MzkxMzA0MzYgMTI1Ljg2NzM2NiA1OC43MTMwNDM0NzgyNjA4NyAxMjUuODE2NzUgNjEuMDY5NTY1MjE3MzkxMyAxMjUuNzcyNTcyIDYzLjQyNjA4Njk1NjUyMTc0IDEyNS43MjM2MjEgNjUuNzgyNjA4Njk1NjUyMTcgMTI1LjY3NjIyNCA2OC4xMzkxMzA0MzQ3ODI2IDEyNS42Mjg4MjcgNzAuNDk1NjUyMTczOTEzMDQgMTI1LjU4MzIwNiA3Mi44NTIxNzM5MTMwNDM0OSAxMjUuNTM1ODA5IDc1LjIwODY5NTY1MjE3MzkyIDEyNS40ODgxOSA3Ny41NjUyMTczOTEzMDQzNCAxMjUuNDQyMDE0IDc5LjkyMTczOTEzMDQzNDc5IDEyNS4zOTQwNjIgODIuMjc4MjYwODY5NTY1MjIgMTI1LjM0NzQ0MiA4NC42MzQ3ODI2MDg2OTU2NCAxMjUuMjk5MDQ2IDg2Ljk5MTMwNDM0NzgyNjA5IDEyNS4yNTA1MzkgODkuMzQ3ODI2MDg2OTU2NTMgMTI1LjIwNDkxOCA5MS43MDQzNDc4MjYwODY5NiAxMjUuMTU1OTY3IDk0LjA2MDg2OTU2NTIxNzM5IDEyNS4xMDg0NTkgOTYuNDE3MzkxMzA0MzQ3ODMgMTI1LjA2MTI4NCA5OC43NzM5MTMwNDM0NzgyNiAxMjUuMDE1NjYzIDEwMS4xMzA0MzQ3ODI2MDg3IDEyNC45NjgzNzcgMTAzLjQ4Njk1NjUyMTczOTEzIDEyNC45MjE2NDYgMTA1Ljg0MzQ3ODI2MDg2OTU3IDEyNC44Nzc5MTIgMTA4LjIwMDAwMDAwMDAwMDAyIDEyNC44MzI1MTMgMTEwLjU1NjUyMTczOTEzMDQzIDEyNC43ODg0NDYgMTEyLjkxMzA0MzQ3ODI2MDg3IDEyNC43NDQyNjggMTE1LjI2OTU2NTIxNzM5MTMgMTI0LjY5Njg3MSAxMTcuNjI2MDg2OTU2NTIxNzMgMTI0LjY1NTI0NiAxMTkuOTgyNjA4Njk1NjUyMTkgMTI0LjYwOTA3IDEyMi4zMzkxMzA0MzQ3ODI2IDEyNC41NjQyMjYgMTI0LjY5NTY1MjE3MzkxMzA1IDEyNC41MTc2MDYgMTI3LjA1MjE3MzkxMzA0MzQ2IDEyNC40NzI0MjkgMTI5LjQwODY5NTY1MjE3MzkyIDEyNC40MjU1ODcwMDAwMDAwMSAxMzEuNzY1MjE3MzkxMzA0MzYgMTI0LjM3ODUyMyAxMzQuMTIxNzM5MTMwNDM0NzggMTI0LjMzMjc5MSAxMzYuNDc4MjYwODY5NTY1MjIgMTI0LjI4NTM5NCAxMzguODM0NzgyNjA4Njk1NjYgMTI0LjIzOTMyOSAxNDEuMTkxMzA0MzQ3ODI2MDggMTI0LjE5NDU5NiAxNDMuNTQ3ODI2MDg2OTU2NTIgMTI0LjE0MzY0NyAxNDUuOTA0MzQ3ODI2MDg2OTYgMTI0LjEwMDEzNSAxNDguMjYwODY5NTY1MjE3MzggMTI0LjA1MTg1IDE1MC42MTczOTEzMDQzNDc4IDEyNC4wMDUwMDggMTUyLjk3MzkxMzA0MzQ3ODI2IDEyMy45NTYzOSAxNTUuMzMwNDM0NzgyNjA4NjggMTIzLjkwOTEwNCAxNTcuNjg2OTU2NTIxNzM5MTIgMTIzLjg2MDA0MTk5OTk5OTk5IDE2MC4wNDM0NzgyNjA4Njk1NiAxMjMuODEwODY5IDE2Mi40IDEyMy43NjYzNTggMTY0Ljc1NjUyMTczOTEzMDQgMTIzLjcxMzYzMyAxNjcuMTEzMDQzNDc4MjYwODYgMTIzLjY2NTQ1OSAxNjkuNDY5NTY1MjE3MzkxMyAxMjMuNjE1NjIgMTcxLjgyNjA4Njk1NjUyMTcyIDEyMy41NjU0NDggMTc0LjE4MjYwODY5NTY1MjE2IDEyMy41MjAwNDkgMTc2LjUzOTEzMDQzNDc4MjYgMTIzLjQ3Mjg3NCAxNzguODk1NjUyMTczOTEzMDUgMTIzLjQyMDU5MyAxODEuMjUyMTczOTEzMDQzNDYgMTIzLjM2OTc1NSAxODMuNjA4Njk1NjUyMTczOSAxMjMuMzI1OTEgMTg1Ljk2NTIxNzM5MTMwNDM1IDEyMy4yNzY5NTkgMTg4LjMyMTczOTEzMDQzNDc2IDEyMy4yMzI2NyAxOTAuNjc4MjYwODY5NTY1MiAxMjMuMTg2ODI3IDE5My4wMzQ3ODI2MDg2OTU2MiAxMjMuMTQzNDI2IDE5NS4zOTEzMDQzNDc4MjYxIDEyMy4xMDI5MTEgMTk3Ljc0NzgyNjA4Njk1NjU0IDEyMy4wNTc5NTYgMjAwLjEwNDM0NzgyNjA4NjkyIDEyMy4wMTQzMzMgMjAyLjQ2MDg2OTU2NTIxNzM3IDEyMi45NzQ4MTcgMjA0LjgxNzM5MTMwNDM0Nzg0IDEyMi45MzMzMDMgMjA3LjE3MzkxMzA0MzQ3ODIyIDEyMi44OTYyMjkgMjA5LjUzMDQzNDc4MjYwODcgMTIyLjg2MDM3NiAyMTEuODg2OTU2NTIxNzM5MSAxMjIuODIwNzQ5IDIxNC4yNDM0NzgyNjA4Njk1NSAxMjIuNzgyMjMyIDIxNi42IDEyMi43NDM0OTMgMjE4Ljk1NjUyMTczOTEzMDQ0IDEyMi43MDYwODYgMjIxLjMxMzA0MzQ3ODI2MDgyIDEyMi42Njg0NTcgMjIzLjY2OTU2NTIxNzM5MTMyIDEyMi42MzA5MzkgMjI2LjAyNjA4Njk1NjUyMTc0IDEyMi41OTU1MyAyMjguMzgyNjA4Njk1NjUyMTUgMTIyLjU2MDU2NSAyMzAuNzM5MTMwNDM0NzgyNjIgMTIyLjUyNjcxIDIzMy4wOTU2NTIxNzM5MTMwNCAxMjIuNDg2NzUgMjM1LjQ1MjE3MzkxMzA0MzQ4IDEyMi40NTAzNDIgMjM3LjgwODY5NTY1MjE3MzkgMTIyLjQxMjYwMTk5OTk5OTk5IDI0MC4xNjUyMTczOTEzMDQzNyAxMjIuMzc1OTcyIDI0Mi41MjE3MzkxMzA0MzQ3OCAxMjIuMzM5MzQyIDI0NC44NzgyNjA4Njk1NjUyMiAxMjIuMzAwMDQ4IDI0Ny4yMzQ3ODI2MDg2OTU2NCAxMjIuMjYzMDg1IDI0OS41OTEzMDQzNDc4MjYxIDEyMi4yMjczNDMgMjUxLjk0NzgyNjA4Njk1NjUyIDEyMi4xODc4MjcgMjU0LjMwNDM0NzgyNjA4Njk0IDEyMi4xNDk0MjEgMjU2LjY2MDg2OTU2NTIxNzM1IDEyMi4xMTA5MDQgMjU5LjAxNzM5MTMwNDM0NzggMTIyLjA3NTkzOSAyNjEuMzczOTEzMDQzNDc4MyAxMjIuMDM3MzExIDI2My43MzA0MzQ3ODI2MDg2NSAxMjIuMDAxMDE0IDI2Ni4wODY5NTY1MjE3MzkxIDEyMS45NTgxNjggMjY4LjQ0MzQ3ODI2MDg2OTYgMTIxLjkxMjk5MSAyNzAuOCAxMjEuODYzMDQxIDI3My4xNTY1MjE3MzkxMzA0IDEyMS43OTkyMTYgMjc1LjUxMzA0MzQ3ODI2MDggMTIxLjczNTM5MDk5OTk5OTk5IDI3Ny44Njk1NjUyMTczOTEzIDEyMS42NjUxMjggMjgwLjIyNjA4Njk1NjUyMTcgMTIxLjU5MzUzMyAyODIuNTgyNjA4Njk1NjUyMTQgMTIxLjUxOTE2Mjk5OTk5OTk5IDI4NC45MzkxMzA0MzQ3ODI2IDEyMS40Mzg2ODggMjg3LjI5NTY1MjE3MzkxMyAxMjEuMzY1ODcyIDI4OS42NTIxNzM5MTMwNDM0NCAxMjEuMjgxNjIzIDI5Mi4wMDg2OTU2NTIxNzM5IDEyMS4yMDQ0NzggMjk0LjM2NTIxNzM5MTMwNDMgMTIxLjExMDEyOCAyOTYuNzIxNzM5MTMwNDM0OCAxMjEuMDIxMTA2IDI5OS4wNzgyNjA4Njk1NjUyIDEyMC45Mjc4NjYgMzAxLjQzNDc4MjYwODY5NTYgMTIwLjgzNDA3MSAzMDMuNzkxMzA0MzQ3ODI2MSAxMjAuNzQ1NzE1IDMwNi4xNDc4MjYwODY5NTY1IDEyMC42NDc4MTMgMzA4LjUwNDM0NzgyNjA4NjkgMTIwLjUwODk1MiAzMTAuODYwODY5NTY1MjE3NCAxMjAuNDYyMTEgMzEzLjIxNzM5MTMwNDM0NzggMTIwLjM1Nzc3IDMxNS41NzM5MTMwNDM0NzgyIDEyMC4yNjM3NTMwMDAwMDAwMSAzMTcuOTMwNDM0NzgyNjA4NyAxMjAuMTcyNTExIDMyMC4yODY5NTY1MjE3MzkxIDEyMC4wNjQzOTcgMzIyLjY0MzQ3ODI2MDg2OTYgMTE5Ljk2NzkzOCAzMjUgMTE5Ljg2OTI1OSIvPjwvZz48ZyBkYXRhLWFjLXdyYXBwZXItaWQ9IjY5MyIgY2xpcC1wYXRoPSJ1cmwoJnF1b3Q7I2FjX2NsaXBfamgmcXVvdDspIiBjbGlwUGF0aFVuaXRzPSJ1c2VyU3BhY2VPblVzZSIgaWQ9ImFjX2xheWVyX2prIi8+PGcgZGF0YS1hYy13cmFwcGVyLWlkPSI2OTQiIGNsaXAtcGF0aD0idXJsKCZxdW90OyNhY19jbGlwX2poJnF1b3Q7KSIgY2xpcFBhdGhVbml0cz0idXNlclNwYWNlT25Vc2UiIGlkPSJhY19sYXllcl9qbCIvPjxnIGRhdGEtYWMtd3JhcHBlci1pZD0iNjg4IiBjbGlwLXBhdGg9InVybCgmcXVvdDsjYWNfY2xpcF9qYSZxdW90OykiIGNsaXBQYXRoVW5pdHM9InVzZXJTcGFjZU9uVXNlIiBpZD0iYWNfbGF5ZXJfamQiLz48ZyBkYXRhLWFjLXdyYXBwZXItaWQ9IjY4OSIgY2xpcC1wYXRoPSJ1cmwoJnF1b3Q7I2FjX2NsaXBfamEmcXVvdDspIiBjbGlwUGF0aFVuaXRzPSJ1c2VyU3BhY2VPblVzZSIgaWQ9ImFjX2xheWVyX2plIi8+PHBhdGggZGF0YS1hYy13cmFwcGVyLWlkPSI2NTMiIGlkPSJhY19wYXRoX2ljIiBmaWxsPSJub25lIiBzdHJva2U9IiNDRUNFQ0UiIGQ9Ik0gNTQgMTM3LjUgTCAzMjYgMTM3LjUiLz48cGF0aCBkYXRhLWFjLXdyYXBwZXItaWQ9IjY1NCIgaWQ9ImFjX3BhdGhfaWQiIGZpbGw9Im5vbmUiIHN0cm9rZT0iI0NFQ0VDRSIgZD0iTSA1NC41IDEzOCBMIDU0LjUgMTQ0IE0gNTguNSAxMzggTCA1OC41IDE0NCBNIDYzLjUgMTM4IEwgNjMuNSAxNDQgTSA2OC41IDEzOCBMIDY4LjUgMTQ0IE0gNzIuNSAxMzggTCA3Mi41IDE0NCBNIDc3LjUgMTM4IEwgNzcuNSAxNDQgTSA4Mi41IDEzOCBMIDgyLjUgMTQ0IE0gODYuNSAxMzggTCA4Ni41IDE0NCBNIDkxLjUgMTM4IEwgOTEuNSAxNDQgTSA5Ni41IDEzOCBMIDk2LjUgMTQ0IE0gMTAxLjUgMTM4IEwgMTAxLjUgMTQ0IE0gMTA1LjUgMTM4IEwgMTA1LjUgMTQ0IE0gMTEwLjUgMTM4IEwgMTEwLjUgMTQ0IE0gMTE1LjUgMTM4IEwgMTE1LjUgMTQ0IE0gMTE5LjUgMTM4IEwgMTE5LjUgMTQ0IE0gMTI0LjUgMTM4IEwgMTI0LjUgMTQ0IE0gMTI5LjUgMTM4IEwgMTI5LjUgMTQ0IE0gMTM0LjUgMTM4IEwgMTM0LjUgMTQ0IE0gMTM4LjUgMTM4IEwgMTM4LjUgMTQ0IE0gMTQzLjUgMTM4IEwgMTQzLjUgMTQ0IE0gMTQ4LjUgMTM4IEwgMTQ4LjUgMTQ0IE0gMTUyLjUgMTM4IEwgMTUyLjUgMTQ0IE0gMTU3LjUgMTM4IEwgMTU3LjUgMTQ0IE0gMTYyLjUgMTM4IEwgMTYyLjUgMTQ0IE0gMTY3LjUgMTM4IEwgMTY3LjUgMTQ0IE0gMTcxLjUgMTM4IEwgMTcxLjUgMTQ0IE0gMTc2LjUgMTM4IEwgMTc2LjUgMTQ0IE0gMTgxLjUgMTM4IEwgMTgxLjUgMTQ0IE0gMTg1LjUgMTM4IEwgMTg1LjUgMTQ0IE0gMTkwLjUgMTM4IEwgMTkwLjUgMTQ0IE0gMTk1LjUgMTM4IEwgMTk1LjUgMTQ0IE0gMjAwLjUgMTM4IEwgMjAwLjUgMTQ0IE0gMjA0LjUgMTM4IEwgMjA0LjUgMTQ0IE0gMjA5LjUgMTM4IEwgMjA5LjUgMTQ0IE0gMjE0LjUgMTM4IEwgMjE0LjUgMTQ0IE0gMjE4LjUgMTM4IEwgMjE4LjUgMTQ0IE0gMjIzLjUgMTM4IEwgMjIzLjUgMTQ0IE0gMjI4LjUgMTM4IEwgMjI4LjUgMTQ0IE0gMjMzLjUgMTM4IEwgMjMzLjUgMTQ0IE0gMjM3LjUgMTM4IEwgMjM3LjUgMTQ0IE0gMjQyLjUgMTM4IEwgMjQyLjUgMTQ0IE0gMjQ3LjUgMTM4IEwgMjQ3LjUgMTQ0IE0gMjUxLjUgMTM4IEwgMjUxLjUgMTQ0IE0gMjU2LjUgMTM4IEwgMjU2LjUgMTQ0IE0gMjYxLjUgMTM4IEwgMjYxLjUgMTQ0IE0gMjY2LjUgMTM4IEwgMjY2LjUgMTQ0IE0gMjcwLjUgMTM4IEwgMjcwLjUgMTQ0IE0gMjc1LjUgMTM4IEwgMjc1LjUgMTQ0IE0gMjgwLjUgMTM4IEwgMjgwLjUgMTQ0IE0gMjg0LjUgMTM4IEwgMjg0LjUgMTQ0IE0gMjg5LjUgMTM4IEwgMjg5LjUgMTQ0IE0gMjk0LjUgMTM4IEwgMjk0LjUgMTQ0IE0gMjk5LjUgMTM4IEwgMjk5LjUgMTQ0IE0gMzAzLjUgMTM4IEwgMzAzLjUgMTQ0IE0gMzA4LjUgMTM4IEwgMzA4LjUgMTQ0IE0gMzEzLjUgMTM4IEwgMzEzLjUgMTQ0IE0gMzE3LjUgMTM4IEwgMzE3LjUgMTQ0IE0gMzIyLjUgMTM4IEwgMzIyLjUgMTQ0IE0gMzI1LjUgMTM4IEwgMzI1LjUgMTQ0Ii8+PGcgZGF0YS1hYy13cmFwcGVyLWlkPSI2NTUiIGlkPSJhY19sYXllcl9pdSI+PGcgZGF0YS1hYy13cmFwcGVyLWlkPSI2NTYiIGlkPSJhY19sYXllcl9pZiI+PGcgZGF0YS1hYy13cmFwcGVyLWlkPSI2NTciIGlkPSJhY191bm1hbmFnZWFibGUtbGF5ZXJfaWUiPjx0ZXh0IGFyaWEtaGlkZGVuPSJ0cnVlIiBmb250LXN0eWxlPSJub3JtYWwiIGZvbnQtdmFyaWFudD0ibm9ybWFsIiBmb250LWZhbWlseT0iVmVyZGFuYSwgSGVsdmV0aWNhLCBBcmlhbCwgc2Fucy1zZXJpZiIgZm9udC1zaXplPSI2IiBmb250LXdlaWdodD0ibm9ybWFsIiBsZXR0ZXItc3BhY2luZz0ibm9ybWFsIiB0ZXh0LWRlY29yYXRpb249Im5vbmUiIGZpbGw9IiM3Yzg2OGUiIG9wYWNpdHk9IjEiIHg9IjQyLjYwMTU2MjUiIHk9IjE1NSI+MTEvMjAxNDwvdGV4dD48L2c+PC9nPjxnIGRhdGEtYWMtd3JhcHBlci1pZD0iNjU4IiBpZD0iYWNfbGF5ZXJfaWgiPjxnIGRhdGEtYWMtd3JhcHBlci1pZD0iNjU5IiBpZD0iYWNfdW5tYW5hZ2VhYmxlLWxheWVyX2lnIj48dGV4dCBhcmlhLWhpZGRlbj0idHJ1ZSIgZm9udC1zdHlsZT0ibm9ybWFsIiBmb250LXZhcmlhbnQ9Im5vcm1hbCIgZm9udC1mYW1pbHk9IlZlcmRhbmEsIEhlbHZldGljYSwgQXJpYWwsIHNhbnMtc2VyaWYiIGZvbnQtc2l6ZT0iNiIgZm9udC13ZWlnaHQ9Im5vcm1hbCIgbGV0dGVyLXNwYWNpbmc9Im5vcm1hbCIgdGV4dC1kZWNvcmF0aW9uPSJub25lIiBmaWxsPSIjN2M4NjhlIiBvcGFjaXR5PSIxIiB4PSI3OS42MDE1NjI1IiB5PSIxNTUiPjAzLzIwMTY8L3RleHQ+PC9nPjwvZz48ZyBkYXRhLWFjLXdyYXBwZXItaWQ9IjY2MCIgaWQ9ImFjX2xheWVyX2lqIj48ZyBkYXRhLWFjLXdyYXBwZXItaWQ9IjY2MSIgaWQ9ImFjX3VubWFuYWdlYWJsZS1sYXllcl9paSI+PHRleHQgYXJpYS1oaWRkZW49InRydWUiIGZvbnQtc3R5bGU9Im5vcm1hbCIgZm9udC12YXJpYW50PSJub3JtYWwiIGZvbnQtZmFtaWx5PSJWZXJkYW5hLCBIZWx2ZXRpY2EsIEFyaWFsLCBzYW5zLXNlcmlmIiBmb250LXNpemU9IjYiIGZvbnQtd2VpZ2h0PSJub3JtYWwiIGxldHRlci1zcGFjaW5nPSJub3JtYWwiIHRleHQtZGVjb3JhdGlvbj0ibm9uZSIgZmlsbD0iIzdjODY4ZSIgb3BhY2l0eT0iMSIgeD0iMTE3LjYwMTU2MjUiIHk9IjE1NSI+MDcvMjAxNzwvdGV4dD48L2c+PC9nPjxnIGRhdGEtYWMtd3JhcHBlci1pZD0iNjYyIiBpZD0iYWNfbGF5ZXJfaWwiPjxnIGRhdGEtYWMtd3JhcHBlci1pZD0iNjYzIiBpZD0iYWNfdW5tYW5hZ2VhYmxlLWxheWVyX2lrIj48dGV4dCBhcmlhLWhpZGRlbj0idHJ1ZSIgZm9udC1zdHlsZT0ibm9ybWFsIiBmb250LXZhcmlhbnQ9Im5vcm1hbCIgZm9udC1mYW1pbHk9IlZlcmRhbmEsIEhlbHZldGljYSwgQXJpYWwsIHNhbnMtc2VyaWYiIGZvbnQtc2l6ZT0iNiIgZm9udC13ZWlnaHQ9Im5vcm1hbCIgbGV0dGVyLXNwYWNpbmc9Im5vcm1hbCIgdGV4dC1kZWNvcmF0aW9uPSJub25lIiBmaWxsPSIjN2M4NjhlIiBvcGFjaXR5PSIxIiB4PSIxNTQuNjAxNTYyNSIgeT0iMTU1Ij4xMS8yMDE4PC90ZXh0PjwvZz48L2c+PGcgZGF0YS1hYy13cmFwcGVyLWlkPSI2NjQiIGlkPSJhY19sYXllcl9pbiI+PGcgZGF0YS1hYy13cmFwcGVyLWlkPSI2NjUiIGlkPSJhY191bm1hbmFnZWFibGUtbGF5ZXJfaW0iPjx0ZXh0IGFyaWEtaGlkZGVuPSJ0cnVlIiBmb250LXN0eWxlPSJub3JtYWwiIGZvbnQtdmFyaWFudD0ibm9ybWFsIiBmb250LWZhbWlseT0iVmVyZGFuYSwgSGVsdmV0aWNhLCBBcmlhbCwgc2Fucy1zZXJpZiIgZm9udC1zaXplPSI2IiBmb250LXdlaWdodD0ibm9ybWFsIiBsZXR0ZXItc3BhY2luZz0ibm9ybWFsIiB0ZXh0LWRlY29yYXRpb249Im5vbmUiIGZpbGw9IiM3Yzg2OGUiIG9wYWNpdHk9IjEiIHg9IjE5Mi42MDE1NjI1IiB5PSIxNTUiPjAzLzIwMjA8L3RleHQ+PC9nPjwvZz48ZyBkYXRhLWFjLXdyYXBwZXItaWQ9IjY2NiIgaWQ9ImFjX2xheWVyX2lwIj48ZyBkYXRhLWFjLXdyYXBwZXItaWQ9IjY2NyIgaWQ9ImFjX3VubWFuYWdlYWJsZS1sYXllcl9pbyI+PHRleHQgYXJpYS1oaWRkZW49InRydWUiIGZvbnQtc3R5bGU9Im5vcm1hbCIgZm9udC12YXJpYW50PSJub3JtYWwiIGZvbnQtZmFtaWx5PSJWZXJkYW5hLCBIZWx2ZXRpY2EsIEFyaWFsLCBzYW5zLXNlcmlmIiBmb250LXNpemU9IjYiIGZvbnQtd2VpZ2h0PSJub3JtYWwiIGxldHRlci1zcGFjaW5nPSJub3JtYWwiIHRleHQtZGVjb3JhdGlvbj0ibm9uZSIgZmlsbD0iIzdjODY4ZSIgb3BhY2l0eT0iMSIgeD0iMjMwLjYwMTU2MjUiIHk9IjE1NSI+MDcvMjAyMTwvdGV4dD48L2c+PC9nPjxnIGRhdGEtYWMtd3JhcHBlci1pZD0iNjY4IiBpZD0iYWNfbGF5ZXJfaXIiPjxnIGRhdGEtYWMtd3JhcHBlci1pZD0iNjY5IiBpZD0iYWNfdW5tYW5hZ2VhYmxlLWxheWVyX2lxIj48dGV4dCBhcmlhLWhpZGRlbj0idHJ1ZSIgZm9udC1zdHlsZT0ibm9ybWFsIiBmb250LXZhcmlhbnQ9Im5vcm1hbCIgZm9udC1mYW1pbHk9IlZlcmRhbmEsIEhlbHZldGljYSwgQXJpYWwsIHNhbnMtc2VyaWYiIGZvbnQtc2l6ZT0iNiIgZm9udC13ZWlnaHQ9Im5vcm1hbCIgbGV0dGVyLXNwYWNpbmc9Im5vcm1hbCIgdGV4dC1kZWNvcmF0aW9uPSJub25lIiBmaWxsPSIjN2M4NjhlIiBvcGFjaXR5PSIxIiB4PSIyNjcuNjAxNTYyNSIgeT0iMTU1Ij4xMS8yMDIyPC90ZXh0PjwvZz48L2c+PGcgZGF0YS1hYy13cmFwcGVyLWlkPSI2NzAiIGlkPSJhY19sYXllcl9pdCI+PGcgZGF0YS1hYy13cmFwcGVyLWlkPSI2NzEiIGlkPSJhY191bm1hbmFnZWFibGUtbGF5ZXJfaXMiPjx0ZXh0IGFyaWEtaGlkZGVuPSJ0cnVlIiBmb250LXN0eWxlPSJub3JtYWwiIGZvbnQtdmFyaWFudD0ibm9ybWFsIiBmb250LWZhbWlseT0iVmVyZGFuYSwgSGVsdmV0aWNhLCBBcmlhbCwgc2Fucy1zZXJpZiIgZm9udC1zaXplPSI2IiBmb250LXdlaWdodD0ibm9ybWFsIiBsZXR0ZXItc3BhY2luZz0ibm9ybWFsIiB0ZXh0LWRlY29yYXRpb249Im5vbmUiIGZpbGw9IiM3Yzg2OGUiIG9wYWNpdHk9IjEiIHg9IjMwNS42MDE1NjI1IiB5PSIxNTUiPjAzLzIwMjQ8L3RleHQ+PC9nPjwvZz48L2c+PHBhdGggZGF0YS1hYy13cmFwcGVyLWlkPSI2NzIiIGlkPSJhY19wYXRoX2l2IiBmaWxsPSJub25lIiBzdHJva2U9IiNDRUNFQ0UiIGQ9Ik0gNTQuNSAyNiBMIDU0LjUgMTM4Ii8+PHBhdGggZGF0YS1hYy13cmFwcGVyLWlkPSI2NzMiIGlkPSJhY19wYXRoX2l3IiBmaWxsPSJub25lIiBzdHJva2U9IiNDRUNFQ0UiIGQ9Ik0gNTQgMTM3LjUgTCA0OCAxMzcuNSBNIDU0IDEwOS41IEwgNDggMTA5LjUgTSA1NCA4MS41IEwgNDggODEuNSBNIDU0IDUzLjUgTCA0OCA1My41IE0gNTQgMjYuNSBMIDQ4IDI2LjUiLz48ZyBkYXRhLWFjLXdyYXBwZXItaWQ9IjY3NCIgaWQ9ImFjX2xheWVyX2o3Ij48ZyBkYXRhLWFjLXdyYXBwZXItaWQ9IjY3NSIgaWQ9ImFjX2xheWVyX2l5Ij48ZyBkYXRhLWFjLXdyYXBwZXItaWQ9IjY3NiIgaWQ9ImFjX3VubWFuYWdlYWJsZS1sYXllcl9peCI+PHRleHQgYXJpYS1oaWRkZW49InRydWUiIGZvbnQtc3R5bGU9Im5vcm1hbCIgZm9udC12YXJpYW50PSJub3JtYWwiIGZvbnQtZmFtaWx5PSJWZXJkYW5hLCBIZWx2ZXRpY2EsIEFyaWFsLCBzYW5zLXNlcmlmIiBmb250LXNpemU9IjYiIGZvbnQtd2VpZ2h0PSJub3JtYWwiIGxldHRlci1zcGFjaW5nPSJub3JtYWwiIHRleHQtZGVjb3JhdGlvbj0ibm9uZSIgZmlsbD0iIzdjODY4ZSIgb3BhY2l0eT0iMSIgeD0iMzYuMTg1NTQ2ODc1IiB5PSIxMzkiPiQwPC90ZXh0PjwvZz48L2c+PGcgZGF0YS1hYy13cmFwcGVyLWlkPSI2NzciIGlkPSJhY19sYXllcl9qMCI+PGcgZGF0YS1hYy13cmFwcGVyLWlkPSI2NzgiIGlkPSJhY191bm1hbmFnZWFibGUtbGF5ZXJfaXoiPjx0ZXh0IGFyaWEtaGlkZGVuPSJ0cnVlIiBmb250LXN0eWxlPSJub3JtYWwiIGZvbnQtdmFyaWFudD0ibm9ybWFsIiBmb250LWZhbWlseT0iVmVyZGFuYSwgSGVsdmV0aWNhLCBBcmlhbCwgc2Fucy1zZXJpZiIgZm9udC1zaXplPSI2IiBmb250LXdlaWdodD0ibm9ybWFsIiBsZXR0ZXItc3BhY2luZz0ibm9ybWFsIiB0ZXh0LWRlY29yYXRpb249Im5vbmUiIGZpbGw9IiM3Yzg2OGUiIG9wYWNpdHk9IjEiIHg9IjE0LjkzMDY2NDA2MjUiIHk9IjExMSI+JDI1MCwwMDA8L3RleHQ+PC9nPjwvZz48ZyBkYXRhLWFjLXdyYXBwZXItaWQ9IjY3OSIgaWQ9ImFjX2xheWVyX2oyIj48ZyBkYXRhLWFjLXdyYXBwZXItaWQ9IjY4MCIgaWQ9ImFjX3VubWFuYWdlYWJsZS1sYXllcl9qMSI+PHRleHQgYXJpYS1oaWRkZW49InRydWUiIGZvbnQtc3R5bGU9Im5vcm1hbCIgZm9udC12YXJpYW50PSJub3JtYWwiIGZvbnQtZmFtaWx5PSJWZXJkYW5hLCBIZWx2ZXRpY2EsIEFyaWFsLCBzYW5zLXNlcmlmIiBmb250LXNpemU9IjYiIGZvbnQtd2VpZ2h0PSJub3JtYWwiIGxldHRlci1zcGFjaW5nPSJub3JtYWwiIHRleHQtZGVjb3JhdGlvbj0ibm9uZSIgZmlsbD0iIzdjODY4ZSIgb3BhY2l0eT0iMSIgeD0iMTQuOTMwNjY0MDYyNSIgeT0iODQiPiQ1MDAsMDAwPC90ZXh0PjwvZz48L2c+PGcgZGF0YS1hYy13cmFwcGVyLWlkPSI2ODEiIGlkPSJhY19sYXllcl9qNCI+PGcgZGF0YS1hYy13cmFwcGVyLWlkPSI2ODIiIGlkPSJhY191bm1hbmFnZWFibGUtbGF5ZXJfajMiPjx0ZXh0IGFyaWEtaGlkZGVuPSJ0cnVlIiBmb250LXN0eWxlPSJub3JtYWwiIGZvbnQtdmFyaWFudD0ibm9ybWFsIiBmb250LWZhbWlseT0iVmVyZGFuYSwgSGVsdmV0aWNhLCBBcmlhbCwgc2Fucy1zZXJpZiIgZm9udC1zaXplPSI2IiBmb250LXdlaWdodD0ibm9ybWFsIiBsZXR0ZXItc3BhY2luZz0ibm9ybWFsIiB0ZXh0LWRlY29yYXRpb249Im5vbmUiIGZpbGw9IiM3Yzg2OGUiIG9wYWNpdHk9IjEiIHg9IjE0LjkzMDY2NDA2MjUiIHk9IjU2Ij4kNzUwLDAwMDwvdGV4dD48L2c+PC9nPjxnIGRhdGEtYWMtd3JhcHBlci1pZD0iNjgzIiBpZD0iYWNfbGF5ZXJfajYiPjxnIGRhdGEtYWMtd3JhcHBlci1pZD0iNjg0IiBpZD0iYWNfdW5tYW5hZ2VhYmxlLWxheWVyX2o1Ij48dGV4dCBhcmlhLWhpZGRlbj0idHJ1ZSIgZm9udC1zdHlsZT0ibm9ybWFsIiBmb250LXZhcmlhbnQ9Im5vcm1hbCIgZm9udC1mYW1pbHk9IlZlcmRhbmEsIEhlbHZldGljYSwgQXJpYWwsIHNhbnMtc2VyaWYiIGZvbnQtc2l6ZT0iNiIgZm9udC13ZWlnaHQ9Im5vcm1hbCIgbGV0dGVyLXNwYWNpbmc9Im5vcm1hbCIgdGV4dC1kZWNvcmF0aW9uPSJub25lIiBmaWxsPSIjN2M4NjhlIiBvcGFjaXR5PSIxIiB4PSI4LjkzMzU5Mzc1IiB5PSIyOCI+JDEsMDAwLDAwMDwvdGV4dD48L2c+PC9nPjwvZz48cGF0aCBkYXRhLWFjLXdyYXBwZXItaWQ9IjcwMCIgcG9pbnRlci1ldmVudHM9Im5vbmUiIGlkPSJhY19wYXRoX2p0IiBmaWxsPSJub25lIiBzdHJva2U9IiM5NjlFQTUiIGQ9Ik0gMCwwIi8+PHBhdGggZGF0YS1hYy13cmFwcGVyLWlkPSI3MDEiIHBvaW50ZXItZXZlbnRzPSJub25lIiBpZD0iYWNfcGF0aF9qdSIgZmlsbD0ibm9uZSIgc3Ryb2tlPSJub25lIiBkPSJNIDAsMCIvPjxnIGRhdGEtYWMtd3JhcHBlci1pZD0iNjMyIiB0cmFuc2Zvcm09Im1hdHJpeCgxLDAsMCwxLDQzLjUyMDc1MTk1MzEyNSwxMCkiIGNsaXAtcGF0aD0idXJsKCZxdW90OyNhY19jbGlwX2kxJnF1b3Q7KSIgY2xpcFBhdGhVbml0cz0idXNlclNwYWNlT25Vc2UiIGlkPSJhY19sYXllcl9pMyI+PGcgZGF0YS1hYy13cmFwcGVyLWlkPSI2MzMiIGlkPSJhY19sYXllcl9oeiI+PGcgZGF0YS1hYy13cmFwcGVyLWlkPSI2MzQiIGlkPSJhY19sYXllcl9ocSI+PHRleHQgZGF0YS1hYy13cmFwcGVyLWlkPSI2MzUiIGZvbnQtc3R5bGU9Im5vcm1hbCIgZm9udC12YXJpYW50PSJub3JtYWwiIGZvbnQtZmFtaWx5PSJWZXJkYW5hLCBIZWx2ZXRpY2EsIEFyaWFsLCBzYW5zLXNlcmlmIiBmb250LXNpemU9IjUiIGZvbnQtd2VpZ2h0PSJub3JtYWwiIGZpbGw9IiM3Yzg2OGUiIGxldHRlci1zcGFjaW5nPSJub3JtYWwiIHRleHQtZGVjb3JhdGlvbj0ibm9uZSIgZGlyZWN0aW9uPSJsdHIiIHRleHQtYW5jaG9yPSJzdGFydCIgeD0iMTAiIHk9IjUiIGFyaWEtaGlkZGVuPSJ0cnVlIiBpZD0iYWNfdGV4dF9obiIgc3R5bGU9InVzZXItc2VsZWN0OiBub25lOyBmb250LWZhbWlseTogVmVyZGFuYSwgSGVsdmV0aWNhLCBBcmlhbCwgc2Fucy1zZXJpZjsgb3BhY2l0eTogMTsgY3Vyc29yOiBwb2ludGVyOyI+PHRzcGFuIHg9IjEwIiBkeT0iMCI+RnVuZDwvdHNwYW4+PC90ZXh0PjxwYXRoIGRhdGEtYWMtd3JhcHBlci1pZD0iNjM2IiB0cmFuc2Zvcm09Im1hdHJpeCgxLDAsMCwxLDAsMC41KSIgaWQ9ImFjX3BhdGhfaG8iIGZpbGw9IiM2MTIxNDEiIHN0cm9rZT0iIzYxMjE0MSIgc3Ryb2tlLXdpZHRoPSIxIiBkPSJNIDAgMCBMIDUgMCA1IDUgMCA1IFoiIHN0eWxlPSJjdXJzb3I6IHBvaW50ZXI7Ii8+PHBhdGggZGF0YS1hYy13cmFwcGVyLWlkPSI2MzciIGlkPSJhY19yZWN0X2hwIiBmaWxsPSIjRkZGRkZGIiBmaWxsLW9wYWNpdHk9IjAuMDAwMDEiIHN0cm9rZT0ibm9uZSIgZD0iTSAwIDAgTCAyMy4zMjgxMjUgMCAyMy4zMjgxMjUgNiAwIDYgMCAwIFoiIHN0eWxlPSJjdXJzb3I6IHBvaW50ZXI7Ii8+PC9nPjxnIGRhdGEtYWMtd3JhcHBlci1pZD0iNjM4IiB0cmFuc2Zvcm09Im1hdHJpeCgxLDAsMCwxLDM4LjMyODEyNSwwKSIgaWQ9ImFjX2xheWVyX2h1Ij48dGV4dCBkYXRhLWFjLXdyYXBwZXItaWQ9IjYzOSIgZm9udC1zdHlsZT0ibm9ybWFsIiBmb250LXZhcmlhbnQ9Im5vcm1hbCIgZm9udC1mYW1pbHk9IlZlcmRhbmEsIEhlbHZldGljYSwgQXJpYWwsIHNhbnMtc2VyaWYiIGZvbnQtc2l6ZT0iNSIgZm9udC13ZWlnaHQ9Im5vcm1hbCIgZmlsbD0iIzdjODY4ZSIgbGV0dGVyLXNwYWNpbmc9Im5vcm1hbCIgdGV4dC1kZWNvcmF0aW9uPSJub25lIiBkaXJlY3Rpb249Imx0ciIgdGV4dC1hbmNob3I9InN0YXJ0IiB4PSIxMCIgeT0iNSIgYXJpYS1oaWRkZW49InRydWUiIGlkPSJhY190ZXh0X2hyIiBzdHlsZT0idXNlci1zZWxlY3Q6IG5vbmU7IGZvbnQtZmFtaWx5OiBWZXJkYW5hLCBIZWx2ZXRpY2EsIEFyaWFsLCBzYW5zLXNlcmlmOyBvcGFjaXR5OiAxOyBjdXJzb3I6IHBvaW50ZXI7Ij48dHNwYW4geD0iMTAiIGR5PSIwIj5NU0NJIFdvcmxkIFRvdGFsIFJldHVybiBJbmRleCAobmV0LCBBVUQpPC90c3Bhbj48L3RleHQ+PHBhdGggZGF0YS1hYy13cmFwcGVyLWlkPSI2NDAiIHRyYW5zZm9ybT0ibWF0cml4KDEsMCwwLDEsMCwwLjUpIiBpZD0iYWNfcGF0aF9ocyIgZmlsbD0iIzVmNWY1ZiIgc3Ryb2tlPSIjNWY1ZjVmIiBzdHJva2Utd2lkdGg9IjEiIGQ9Ik0gMCAwIEwgNSAwIDUgNSAwIDUgWiIgc3R5bGU9ImN1cnNvcjogcG9pbnRlcjsiLz48cGF0aCBkYXRhLWFjLXdyYXBwZXItaWQ9IjY0MSIgaWQ9ImFjX3JlY3RfaHQiIGZpbGw9IiNGRkZGRkYiIGZpbGwtb3BhY2l0eT0iMC4wMDAwMSIgc3Ryb2tlPSJub25lIiBkPSJNIDAgMCBMIDExOC4yNDgwNDY4NzUgMCAxMTguMjQ4MDQ2ODc1IDYgMCA2IDAgMCBaIiBzdHlsZT0iY3Vyc29yOiBwb2ludGVyOyIvPjwvZz48ZyBkYXRhLWFjLXdyYXBwZXItaWQ9IjY0MiIgdHJhbnNmb3JtPSJtYXRyaXgoMSwwLDAsMSwxNzEuNTc2MTcxODc1LDApIiBpZD0iYWNfbGF5ZXJfaHkiPjx0ZXh0IGRhdGEtYWMtd3JhcHBlci1pZD0iNjQzIiBmb250LXN0eWxlPSJub3JtYWwiIGZvbnQtdmFyaWFudD0ibm9ybWFsIiBmb250LWZhbWlseT0iVmVyZGFuYSwgSGVsdmV0aWNhLCBBcmlhbCwgc2Fucy1zZXJpZiIgZm9udC1zaXplPSI1IiBmb250LXdlaWdodD0ibm9ybWFsIiBmaWxsPSIjN2M4NjhlIiBsZXR0ZXItc3BhY2luZz0ibm9ybWFsIiB0ZXh0LWRlY29yYXRpb249Im5vbmUiIGRpcmVjdGlvbj0ibHRyIiB0ZXh0LWFuY2hvcj0ic3RhcnQiIHg9IjEwIiB5PSI1IiBhcmlhLWhpZGRlbj0idHJ1ZSIgaWQ9ImFjX3RleHRfaHYiIHN0eWxlPSJ1c2VyLXNlbGVjdDogbm9uZTsgZm9udC1mYW1pbHk6IFZlcmRhbmEsIEhlbHZldGljYSwgQXJpYWwsIHNhbnMtc2VyaWY7IG9wYWNpdHk6IDE7IGN1cnNvcjogcG9pbnRlcjsiPjx0c3BhbiB4PSIxMCIgZHk9IjAiPlJCQSBDYXNoIFJhdGUgcGx1cyAzJTwvdHNwYW4+PC90ZXh0PjxwYXRoIGRhdGEtYWMtd3JhcHBlci1pZD0iNjQ0IiB0cmFuc2Zvcm09Im1hdHJpeCgxLDAsMCwxLDAsMC41KSIgaWQ9ImFjX3BhdGhfaHciIGZpbGw9IiNhM2EzYTMiIHN0cm9rZT0iI2EzYTNhMyIgc3Ryb2tlLXdpZHRoPSIxIiBkPSJNIDAgMCBMIDUgMCA1IDUgMCA1IFoiIHN0eWxlPSJjdXJzb3I6IHBvaW50ZXI7Ii8+PHBhdGggZGF0YS1hYy13cmFwcGVyLWlkPSI2NDUiIGlkPSJhY19yZWN0X2h4IiBmaWxsPSIjRkZGRkZGIiBmaWxsLW9wYWNpdHk9IjAuMDAwMDEiIHN0cm9rZT0ibm9uZSIgZD0iTSAwIDAgTCA3MS4zODIzMjQyMTg3NSAwIDcxLjM4MjMyNDIxODc1IDYgMCA2IDAgMCBaIiBzdHlsZT0iY3Vyc29yOiBwb2ludGVyOyIvPjwvZz48L2c+PC9nPjwvZz48L2c+PC9zdmc+

[pdfchart2] => PD94bWwgdmVyc2lvbj0iMS4wIiBlbmNvZGluZz0iVVRGLTgiIHN0YW5kYWxvbmU9Im5vIj8+PHN2ZyB4bWxucz0iaHR0cDovL3d3dy53My5vcmcvMjAwMC9zdmciIGJvcmRlcj0iMCIgZGF0YS1hYy13cmFwcGVyLWlkPSI2MjMiIHdpZHRoPSIzMzAiIGhlaWdodD0iMTY1IiBjbGFzcz0iYW55Y2hhcnQtdWktc3VwcG9ydCIgYWMtaWQ9ImFjX3N0YWdlX2hpIiByb2xlPSJwcmVzZW50YXRpb24iIHN0eWxlPSJkaXNwbGF5OiBibG9jazsiPjxkZWZzPjxjbGlwUGF0aCBjbGlwLXJ1bGU9Im5vbnplcm8iIGlkPSJhY19jbGlwX2kxIj48cGF0aCBkYXRhLWFjLXdyYXBwZXItaWQ9IjY0NiIgaWQ9ImFjX3JlY3RfaTIiIGZpbGw9Im5vbmUiIHN0cm9rZT0iYmxhY2siIGQ9Ik0gMCAwIEwgMjQyLjk1ODQ5NjA5Mzc1IDAgMjQyLjk1ODQ5NjA5Mzc1IDE2IDAgMTYgMCAwIFoiLz48L2NsaXBQYXRoPjxjbGlwUGF0aCBjbGlwLXJ1bGU9Im5vbnplcm8iIGlkPSJhY19jbGlwX2k5Ij48cGF0aCBkYXRhLWFjLXdyYXBwZXItaWQ9IjY1MiIgaWQ9ImFjX3JlY3RfaWEiIGZpbGw9Im5vbmUiIHN0cm9rZT0iYmxhY2siIGQ9Ik0gNTQgMjYgTCAzMjYgMjYgMzI2IDEzOCA1NCAxMzggNTQgMjYgWiIvPjwvY2xpcFBhdGg+PGNsaXBQYXRoIGNsaXAtcnVsZT0ibm9uemVybyIgaWQ9ImFjX2NsaXBfamEiPjxwYXRoIGRhdGEtYWMtd3JhcHBlci1pZD0iNjg3IiBpZD0iYWNfcmVjdF9qYiIgZmlsbD0ibm9uZSIgc3Ryb2tlPSJibGFjayIgZD0iTSA1NSAyNiBMIDMyNiAyNiAzMjYgMTM3IDU1IDEzNyA1NSAyNiBaIi8+PC9jbGlwUGF0aD48Y2xpcFBhdGggY2xpcC1ydWxlPSJub256ZXJvIiBpZD0iYWNfY2xpcF9qaCI+PHBhdGggZGF0YS1hYy13cmFwcGVyLWlkPSI2OTIiIGlkPSJhY19yZWN0X2ppIiBmaWxsPSJub25lIiBzdHJva2U9ImJsYWNrIiBkPSJNIDU1IDI2IEwgMzI2IDI2IDMyNiAxMzcgNTUgMTM3IDU1IDI2IFoiLz48L2NsaXBQYXRoPjxjbGlwUGF0aCBjbGlwLXJ1bGU9Im5vbnplcm8iIGlkPSJhY19jbGlwX2pvIj48cGF0aCBkYXRhLWFjLXdyYXBwZXItaWQ9IjY5NyIgaWQ9ImFjX3JlY3RfanAiIGZpbGw9Im5vbmUiIHN0cm9rZT0iYmxhY2siIGQ9Ik0gNTUgMjYgTCAzMjYgMjYgMzI2IDEzNyA1NSAxMzcgNTUgMjYgWiIvPjwvY2xpcFBhdGg+PGNsaXBQYXRoIGNsaXAtcnVsZT0ibm9uemVybyIgaWQ9ImFjX2NsaXBfanciPjxwYXRoIGRhdGEtYWMtd3JhcHBlci1pZD0iNzAzIiBpZD0iYWNfcmVjdF9qeCIgZmlsbD0ibm9uZSIgc3Ryb2tlPSJibGFjayIgZD0iTSA1NCAyNiBMIDMyNSAyNiAzMjUgMTM3IDU0IDEzNyA1NCAyNiBaIi8+PC9jbGlwUGF0aD48L2RlZnM+PGcgZGF0YS1hYy13cmFwcGVyLWlkPSI2MjQiIGlkPSJhY19sYXllcl9oaiI+PGcgZGF0YS1hYy13cmFwcGVyLWlkPSI2MjkiIHJvbGU9ImFydGljbGUiIGFyaWEtbGFiZWw9ImxpbmUgY2hhcnQgLCB3aXRoIDMgbGluZSBzZXJpZXMsIC4gWS1zY2FsZSBtaW5pbXVtIHZhbHVlIGlzIDAgLCBtYXhpbXVtIHZhbHVlIGlzIDEwMDAwMDAuIFgtc2NhbGUgd2l0aCAxMTYgY2F0ZWdvcmllczogMzAvMTEvMjAxNCwgMzEvMTIvMjAxNCwgMzAvMDEvMjAxNSwgMjcvMDIvMjAxNSwgMzEvMDMvMjAxNSwgMzAvMDQvMjAxNSwgMjkvMDUvMjAxNSwgMzAvMDYvMjAxNSwgMzEvMDcvMjAxNSwgMzEvMDgvMjAxNSwgMzAvMDkvMjAxNSwgMzAvMTAvMjAxNSwgMzAvMTEvMjAxNSwgMzEvMTIvMjAxNSwgMjkvMDEvMjAxNiwgMjkvMDIvMjAxNiwgMzEvMDMvMjAxNiwgMjkvMDQvMjAxNiwgMzEvMDUvMjAxNiwgMzAvMDYvMjAxNiwgMjkvMDcvMjAxNiwgMzEvMDgvMjAxNiwgMzAvMDkvMjAxNiwgMzEvMTAvMjAxNiwgMzAvMTEvMjAxNiwgMzAvMTIvMjAxNiwgMzEvMDEvMjAxNywgMjgvMDIvMjAxNywgMzEvMDMvMjAxNywgMjgvMDQvMjAxNywgMzEvMDUvMjAxNywgMzAvMDYvMjAxNywgMzEvMDcvMjAxNywgMzEvMDgvMjAxNywgMjkvMDkvMjAxNywgMzEvMTAvMjAxNywgMzAvMTEvMjAxNywgMjkvMTIvMjAxNywgMzEvMDEvMjAxOCwgMjgvMDIvMjAxOCwgMjkvMDMvMjAxOCwgMzAvMDQvMjAxOCwgMzEvMDUvMjAxOCwgMjkvMDYvMjAxOCwgMzEvMDcvMjAxOCwgMzEvMDgvMjAxOCwgMjgvMDkvMjAxOCwgMzEvMTAvMjAxOCwgMzAvMTEvMjAxOCwgMzEvMTIvMjAxOCwgMzEvMDEvMjAxOSwgMjgvMDIvMjAxOSwgMjkvMDMvMjAxOSwgMzAvMDQvMjAxOSwgMzEvMDUvMjAxOSwgMjgvMDYvMjAxOSwgMzEvMDcvMjAxOSwgMzAvMDgvMjAxOSwgMzAvMDkvMjAxOSwgMzEvMTAvMjAxOSwgMjkvMTEvMjAxOSwgMzEvMTIvMjAxOSwgMzEvMDEvMjAyMCwgMjgvMDIvMjAyMCwgMzEvMDMvMjAyMCwgMzAvMDQvMjAyMCwgMjkvMDUvMjAyMCwgMzAvMDYvMjAyMCwgMzEvMDcvMjAyMCwgMzEvMDgvMjAyMCwgMzAvMDkvMjAyMCwgMzAvMTAvMjAyMCwgMzAvMTEvMjAyMCwgMzEvMTIvMjAyMCwgMjkvMDEvMjAyMSwgMjYvMDIvMjAyMSwgMzEvMDMvMjAyMSwgMzAvMDQvMjAyMSwgMzEvMDUvMjAyMSwgMzAvMDYvMjAyMSwgMzAvMDcvMjAyMSwgMzEvMDgvMjAyMSwgMzAvMDkvMjAyMSwgMjkvMTAvMjAyMSwgMzAvMTEvMjAyMSwgMzEvMTIvMjAyMSwgMzEvMDEvMjAyMiwgMjgvMDIvMjAyMiwgMzEvMDMvMjAyMiwgMjkvMDQvMjAyMiwgMzEvMDUvMjAyMiwgMzAvMDYvMjAyMiwgMjkvMDcvMjAyMiwgMzEvMDgvMjAyMiwgMzAvMDkvMjAyMiwgMzEvMTAvMjAyMiwgMzAvMTEvMjAyMiwgMzAvMTIvMjAyMiwgMzEvMDEvMjAyMywgMjgvMDIvMjAyMywgMzEvMDMvMjAyMywgMjgvMDQvMjAyMywgMzEvMDUvMjAyMywgMzAvMDYvMjAyMywgMzEvMDcvMjAyMywgMzEvMDgvMjAyMywgMjkvMDkvMjAyMywgMzEvMTAvMjAyMywgMzAvMTEvMjAyMywgMjkvMTIvMjAyMywgMzEvMDEvMjAyNCwgMjkvMDIvMjAyNCwgMjgvMDMvMjAyNCwgMzAvMDQvMjAyNCwgMzEvMDUvMjAyNCwgMjgvMDYvMjAyNCwgLiAiIGlkPSJhY19jaGFydF9oayI+PGcgZGF0YS1hYy13cmFwcGVyLWlkPSI2MzAiIGlkPSJhY19sYXllcl9obSI+PHBhdGggZGF0YS1hYy13cmFwcGVyLWlkPSI2MzEiIGlkPSJhY19wYXRoX2hsIiBmaWxsPSIjRUFFQUVBIiBzdHJva2U9Im5vbmUiIGQ9Ik0gMCAwIEwgMzMwIDAgMzMwIDAgMzMwIDE2NSAzMzAgMTY1IDAgMTY1IDAgMTY1IDAgMCAwIDAgWiIvPjwvZz48cGF0aCBkYXRhLWFjLXdyYXBwZXItaWQ9IjcwMiIgY2xpcC1wYXRoPSJ1cmwoJnF1b3Q7I2FjX2NsaXBfancmcXVvdDspIiBjbGlwUGF0aFVuaXRzPSJ1c2VyU3BhY2VPblVzZSIgaWQ9ImFjX3BhdGhfankiIGZpbGw9Im5vbmUiIHN0cm9rZT0ibm9uZSIgZD0iTSAwLDAiLz48cGF0aCBkYXRhLWFjLXdyYXBwZXItaWQ9IjY0NyIgaWQ9ImFjX3BhdGhfaTQiIGZpbGw9Im5vbmUiIHN0cm9rZT0ibm9uZSIgZD0iTSA1NCAxMzcuNSBMIDMyNSAxMzcuNSAzMjUgMTA5LjUgNTQgMTA5LjUgWiIvPjxwYXRoIGRhdGEtYWMtd3JhcHBlci1pZD0iNjQ4IiBpZD0iYWNfcGF0aF9pNSIgZmlsbD0ibm9uZSIgc3Ryb2tlPSJub25lIiBkPSJNIDU0IDEwOS41IEwgMzI1IDEwOS41IDMyNSA4MS41IDU0IDgxLjUgWiIvPjxwYXRoIGRhdGEtYWMtd3JhcHBlci1pZD0iNjQ5IiBpZD0iYWNfcGF0aF9pNiIgZmlsbD0ibm9uZSIgc3Ryb2tlPSJub25lIiBkPSJNIDU0IDgxLjUgTCAzMjUgODEuNSAzMjUgNTMuNSA1NCA1My41IFoiLz48cGF0aCBkYXRhLWFjLXdyYXBwZXItaWQ9IjY1MCIgaWQ9ImFjX3BhdGhfaTciIGZpbGw9Im5vbmUiIHN0cm9rZT0ibm9uZSIgZD0iTSA1NCA1My41IEwgMzI1IDUzLjUgMzI1IDI2LjUgNTQgMjYuNSBaIi8+PHBhdGggZGF0YS1hYy13cmFwcGVyLWlkPSI2NTEiIGNsaXAtcGF0aD0idXJsKCZxdW90OyNhY19jbGlwX2k5JnF1b3Q7KSIgY2xpcFBhdGhVbml0cz0idXNlclNwYWNlT25Vc2UiIGlkPSJhY19wYXRoX2liIiBmaWxsPSJub25lIiBzdHJva2U9IiNDRUNFQ0UiIGQ9Ik0gNTQgMTM3LjUgTCAzMjUgMTM3LjUgTSA1NCAxMDkuNSBMIDMyNSAxMDkuNSBNIDU0IDgxLjUgTCAzMjUgODEuNSBNIDU0IDUzLjUgTCAzMjUgNTMuNSBNIDU0IDI2LjUgTCAzMjUgMjYuNSIvPjxnIGRhdGEtYWMtd3JhcHBlci1pZD0iNjk1IiBjbGlwLXBhdGg9InVybCgmcXVvdDsjYWNfY2xpcF9qbyZxdW90OykiIGNsaXBQYXRoVW5pdHM9InVzZXJTcGFjZU9uVXNlIiBpZD0iYWNfbGF5ZXJfanEiPjxwYXRoIGRhdGEtYWMtd3JhcHBlci1pZD0iNjk2IiBpZD0iYWNfcGF0aF9qbSIgZmlsbD0ibm9uZSIgc3Ryb2tlPSIjNjEyMTQxIiBzdHJva2Utd2lkdGg9IjEiIGQ9Ik0gNTQgMTI1LjkgTCA1Ni4zNTY1MjE3MzkxMzA0MzYgMTI1Ljg0MjI4IDU4LjcxMzA0MzQ3ODI2MDg3IDEyNC40MjcwMyA2MS4wNjk1NjUyMTczOTEzIDEyNC4xNzI4NDAwMDAwMDAwMSA2My40MjYwODY5NTY1MjE3NCAxMjMuODQ3NjEgNjUuNzgyNjA4Njk1NjUyMTcgMTIxLjg4MjkxIDY4LjEzOTEzMDQzNDc4MjYgMTIwLjYyODYxIDcwLjQ5NTY1MjE3MzkxMzA0IDExOS41MjQxNiA3Mi44NTIxNzM5MTMwNDM0OSAxMjEuMzUwMTEgNzUuMjA4Njk1NjUyMTczOTIgMTIxLjA3ODE2IDc3LjU2NTIxNzM5MTMwNDM0IDExNi43NzM1OCA3OS45MjE3MzkxMzA0MzQ3OSAxMTMuODE5ODcwMDAwMDAwMDEgODIuMjc4MjYwODY5NTY1MjIgMTE2Ljc2NTgxIDg0LjYzNDc4MjYwODY5NTY0IDExMy4xNzk0IDg2Ljk5MTMwNDM0NzgyNjA5IDExMy4xOTM4MyA4OS4zNDc4MjYwODY5NTY1MyAxMDcuNjgyNjggOTEuNzA0MzQ3ODI2MDg2OTYgMTA4LjEwNDQ4IDk0LjA2MDg2OTU2NTIxNzM5IDEwNS45MDY2OCA5Ni40MTczOTEzMDQzNDc4MyAxMDIuNDU0NTc5OTk5OTk5OTkgOTguNzczOTEzMDQzNDc4MjYgOTguMzIwMjc0IDEwMS4xMzA0MzQ3ODI2MDg3IDk0Ljg5MDI2MyAxMDMuNDg2OTU2NTIxNzM5MTMgOTcuMTUyMTEgMTA1Ljg0MzQ3ODI2MDg2OTU3IDk2LjEzNjc5MzAwMDAwMDAxIDEwOC4yMDAwMDAwMDAwMDAwMiA5Ny42OTMxMjQwMDAwMDAwMSAxMTAuNTU2NTIxNzM5MTMwNDMgOTguOTg1Mjc1IDExMi45MTMwNDM0NzgyNjA4NyAxMDIuNzM2NDA5MDAwMDAwMDEgMTE1LjI2OTU2NTIxNzM5MTMgOTkuNTEzNzQ2IDExNy42MjYwODY5NTY1MjE3MyA5OS4xMDkyNjIgMTE5Ljk4MjYwODY5NTY1MjE5IDk4LjQxNjI4OSAxMjIuMzM5MTMwNDM0NzgyNiA5OS4xNzYxOTUgMTI0LjY5NTY1MjE3MzkxMzA1IDEwMi4xNDc3NzYgMTI3LjA1MjE3MzkxMzA0MzQ2IDEwMS44MDM2NzYgMTI5LjQwODY5NTY1MjE3MzkyIDEwMy4zNDQyNDUgMTMxLjc2NTIxNzM5MTMwNDM2IDEwMi43NTc0OTkgMTM0LjEyMTczOTEzMDQzNDc4IDk5Ljg0MDY0MSAxMzYuNDc4MjYwODY5NTY1MjIgOTcuMTI3OTEyIDEzOC44MzQ3ODI2MDg2OTU2NiA5Ni45MTI3OTM5OTk5OTk5OSAxNDEuMTkxMzA0MzQ3ODI2MDggOTcuNTU4MTQ4IDE0My41NDc4MjYwODY5NTY1MiA5Ny4yOTI0MTQwMDAwMDAwMSAxNDUuOTA0MzQ3ODI2MDg2OTYgOTYuODc0ODMyIDE0OC4yNjA4Njk1NjUyMTczOCA5Ni44NDc4NTkgMTUwLjYxNzM5MTMwNDM0NzggOTYuNzE4MjExIDE1Mi45NzM5MTMwNDM0NzgyNiA5Ny4xNDM2NzQgMTU1LjMzMDQzNDc4MjYwODY4IDk1LjMxMzUwNTk5OTk5OTk5IDE1Ny42ODY5NTY1MjE3MzkxMiA5NC4zNDY1ODUgMTYwLjA0MzQ3ODI2MDg2OTU2IDg4LjQwNzk3NCAxNjIuNCA4OS40Nzg2OCAxNjQuNzU2NTIxNzM5MTMwNCA5My4xOTI5NjIgMTY3LjExMzA0MzQ3ODI2MDg2IDk0Ljk1NjY0MDk5OTk5OTk5IDE2OS40Njk1NjUyMTczOTEzIDk0Ljc1MTI5MTAwMDAwMDAxIDE3MS44MjYwODY5NTY1MjE3MiA5My44MDA5MDg5OTk5OTk5OSAxNzQuMTgyNjA4Njk1NjUyMTYgOTIuNjM2ODUyIDE3Ni41MzkxMzA0MzQ3ODI2IDkxLjI1OTAwOSAxNzguODk1NjUyMTczOTEzMDUgODkuMDQzMDA1IDE4MS4yNTIxNzM5MTMwNDM0NiA5Mi42MDU2NjEgMTgzLjYwODY5NTY1MjE3MzkgOTAuNTM0ODQ0OTk5OTk5OTkgMTg1Ljk2NTIxNzM5MTMwNDM1IDg2LjU1NTI3MyAxODguMzIxNzM5MTMwNDM0NzYgODYuNDY0MzYzOTk5OTk5OTkgMTkwLjY3ODI2MDg2OTU2NTIgODcuMzAwMTk0IDE5My4wMzQ3ODI2MDg2OTU2MiA4Ny40MjQyOTIgMTk1LjM5MTMwNDM0NzgyNjEgODMuNjk1MjQ3IDE5Ny43NDc4MjYwODY5NTY1NCA4My41NjIyNjkgMjAwLjEwNDM0NzgyNjA4NjkyIDgzLjEwNTUwNCAyMDIuNDYwODY5NTY1MjE3MzcgODQuNzk5MzY0IDIwNC44MTczOTEzMDQzNDc4NCA5NC4wMTc5MTM5OTk5OTk5OSAyMDcuMTczOTEzMDQzNDc4MjIgODkuMTQyNTcyIDIwOS41MzA0MzQ3ODI2MDg3IDg2LjE0NzM0OCAyMTEuODg2OTU2NTIxNzM5MSA4Ny42NDE2Mjk5OTk5OTk5OSAyMTQuMjQzNDc4MjYwODY5NTUgODUuNDU3MzcxOTk5OTk5OTkgMjE2LjYgODMuMzc0MTI0IDIxOC45NTY1MjE3MzkxMzA0NCA4NC41NTgwNTAwMDAwMDAwMSAyMjEuMzEzMDQzNDc4MjYwODIgODQuNTgzMjQ3IDIyMy42Njk1NjUyMTczOTEzMiA3Ny41MDc0NDEgMjI2LjAyNjA4Njk1NjUyMTc0IDczLjc2OTk2IDIyOC4zODI2MDg2OTU2NTIxNSA3MS4zMzEwNjggMjMwLjczOTEzMDQzNDc4MjYyIDcxLjYwODY3OSAyMzMuMDk1NjUyMTczOTEzMDQgNjguNjI1OTk4IDIzNS40NTIxNzM5MTMwNDM0OCA2OS4yOTEzMzIgMjM3LjgwODY5NTY1MjE3MzkgNjkuNjQ2OTc2IDI0MC4xNjUyMTczOTEzMDQzNyA2NS45MDk0OTUgMjQyLjUyMTczOTEzMDQzNDc4IDY4LjQ4MTE0MyAyNDQuODc4MjYwODY5NTY1MjIgNjYuMDEwOTQ5IDI0Ny4yMzQ3ODI2MDg2OTU2NCA2OC4xMjg2MDcgMjQ5LjU5MTMwNDM0NzgyNjEgNjkuOTg1NTI2MDAwMDAwMDEgMjUxLjk0NzgyNjA4Njk1NjUyIDcwLjY2MTYyNyAyNTQuMzA0MzQ3ODI2MDg2OTQgNjcuOTU5NTU0IDI1Ni42NjA4Njk1NjUyMTczNSA3MS4zNzE0NzIgMjU5LjAxNzM5MTMwNDM0NzggNzQuMDcxMTAzMDAwMDAwMDEgMjYxLjM3MzkxMzA0MzQ3ODMgNzkuMDc5MjAxMDAwMDAwMDEgMjYzLjczMDQzNDc4MjYwODY1IDc5LjYzNjk3NiAyNjYuMDg2OTU2NTIxNzM5MSA4Mi4zMjY4MzkgMjY4LjQ0MzQ3ODI2MDg2OTYgODYuMDc0NDIxIDI3MC44IDgxLjgyNzAwNiAyNzMuMTU2NTIxNzM5MTMwNCA4My43ODUzNzkgMjc1LjUxMzA0MzQ3ODI2MDggODguNjk5MjM4MDAwMDAwMDEgMjc3Ljg2OTU2NTIxNzM5MTMgODQuNTk2Njc4IDI4MC4yMjYwODY5NTY1MjE3IDgzLjE2NDc3OCAyODIuNTgyNjA4Njk1NjUyMTQgODMuNzc4MTY0IDI4NC45MzkxMzA0MzQ3ODI2IDgxLjAxMDkzMzk5OTk5OTk5IDI4Ny4yOTU2NTIxNzM5MTMgODEuNTMwMDgxIDI4OS42NTIxNzM5MTMwNDM0NCA4Mi4yNDIzNjggMjkyLjAwODY5NTY1MjE3MzkgNzguNjAxMDEzMDAwMDAwMDEgMjk0LjM2NTIxNzM5MTMwNDMgNzguNjk3NTgzIDI5Ni43MjE3MzkxMzA0MzQ4IDc4LjU4MTY5OTAwMDAwMDAxIDI5OS4wNzgyNjA4Njk1NjUyIDc5LjY0NzE4OCAzMDEuNDM0NzgyNjA4Njk1NiA3OS44NzcyOTA5OTk5OTk5OSAzMDMuNzkxMzA0MzQ3ODI2MSA3OS43MTI1NjcgMzA2LjE0NzgyNjA4Njk1NjUgODQuMjQ1ODA3IDMwOC41MDQzNDc4MjYwODY5IDc4LjUwNjY2MyAzMTAuODYwODY5NTY1MjE3NCA3Mi44MzUzNCAzMTMuMjE3MzkxMzA0MzQ3OCA2Ni43NzQwNzQgMzE1LjU3MzkxMzA0MzQ3ODIgNTMuMDI5MTY2MDAwMDAwMDA0IDMxNy45MzA0MzQ3ODI2MDg3IDUyLjI0MjE3NiAzMjAuMjg2OTU2NTIxNzM5MSA1MS44OTEwODMwMDAwMDAwMSAzMjIuNjQzNDc4MjYwODY5NiAzNy4zMTA2NzgwMDAwMDAwMSAzMjUgNDYuMDA0MTk4Ii8+PC9nPjxnIGRhdGEtYWMtd3JhcHBlci1pZD0iNjkwIiBjbGlwLXBhdGg9InVybCgmcXVvdDsjYWNfY2xpcF9qaCZxdW90OykiIGNsaXBQYXRoVW5pdHM9InVzZXJTcGFjZU9uVXNlIiBpZD0iYWNfbGF5ZXJfamoiPjxwYXRoIGRhdGEtYWMtd3JhcHBlci1pZD0iNjkxIiBpZD0iYWNfcGF0aF9qZiIgZmlsbD0ibm9uZSIgc3Ryb2tlPSIjNWY1ZjVmIiBzdHJva2Utd2lkdGg9IjEiIGQ9Ik0gNTQgMTI1LjkgTCA1Ni4zNTY1MjE3MzkxMzA0MzYgMTI1LjcyODk0OSA1OC43MTMwNDM0NzgyNjA4NyAxMjUuMzcwNDE5IDYxLjA2OTU2NTIxNzM5MTMgMTI0Ljc1MTkyNyA2My40MjYwODY5NTY1MjE3NCAxMjQuNjQ2OTIxIDY1Ljc4MjYwODY5NTY1MjE3IDEyNC43NTQ4MTMgNjguMTM5MTMwNDM0NzgyNiAxMjQuMzM4NTYzIDcwLjQ5NTY1MjE3MzkxMzA0IDEyNC42ODM2NjIgNzIuODUyMTczOTEzMDQzNDkgMTIzLjg3NzgwMiA3NS4yMDg2OTU2NTIxNzM5MiAxMjQuMzA3MTUwMDAwMDAwMDEgNzcuNTY1MjE3MzkxMzA0MzQgMTI0LjY1ODY4NyA3OS45MjE3MzkxMzA0MzQ3OSAxMjMuODg5NzkgODIuMjc4MjYwODY5NTY1MjIgMTI0LjE1NTc0NiA4NC42MzQ3ODI2MDg2OTU2NCAxMjQuNDMyNjkxIDg2Ljk5MTMwNDM0NzgyNjA5IDEyNC44NDcxNjUgODkuMzQ3ODI2MDg2OTU2NTMgMTI1LjA1NDA2OSA5MS43MDQzNDc4MjYwODY5NiAxMjUuMTU1NTIzIDk0LjA2MDg2OTU2NTIxNzM5IDEyNC44NzE5MTggOTYuNDE3MzkxMzA0MzQ3ODMgMTI0LjE1MjMwNSA5OC43NzM5MTMwNDM0NzgyNiAxMjQuNjQwMDM5IDEwMS4xMzA0MzQ3ODI2MDg3IDEyNC4zNzk3NDQgMTAzLjQ4Njk1NjUyMTczOTEzIDEyNC4xODM2MDcgMTA1Ljg0MzQ3ODI2MDg2OTU3IDEyNC4zNDYxMTEwMDAwMDAwMSAxMDguMjAwMDAwMDAwMDAwMDIgMTI0LjUyMDkzNiAxMTAuNTU2NTIxNzM5MTMwNDMgMTIzLjk2MjgyOCAxMTIuOTEzMDQzNDc4MjYwODcgMTIzLjM3ODk2OCAxMTUuMjY5NTY1MjE3MzkxMyAxMjMuNjk0MzE5MDAwMDAwMDEgMTE3LjYyNjA4Njk1NjUyMTczIDEyMy40OTc2MjcgMTE5Ljk4MjYwODY5NTY1MjE5IDEyMy4yNDY1NDUgMTIyLjMzOTEzMDQzNDc4MjYgMTIyLjc2MjkxOCAxMjQuNjk1NjUyMTczOTEzMDUgMTIyLjM5NTM5NyAxMjcuMDUyMTczOTEzMDQzNDYgMTIyLjc3MTEzMiAxMjkuNDA4Njk1NjUyMTczOTIgMTIzLjAwMTc5IDEzMS43NjUyMTczOTEzMDQzNiAxMjIuODkwMjM1IDEzNC4xMjE3MzkxMzA0MzQ3OCAxMjIuNDE3MjY0IDEzNi40NzgyNjA4Njk1NjUyMiAxMjEuNzk0Nzc2IDEzOC44MzQ3ODI2MDg2OTU2NiAxMjEuMzA5ODE3IDE0MS4xOTEzMDQzNDc4MjYwOCAxMjEuNTY1MjI4IDE0My41NDc4MjYwODY5NTY1MiAxMjEuMzA0MTU2IDE0NS45MDQzNDc4MjYwODY5NiAxMjEuMzY1NDI4IDE0OC4yNjA4Njk1NjUyMTczOCAxMjEuNDYyOTk3IDE1MC42MTczOTEzMDQzNDc4IDEyMS4wMzA0MyAxNTIuOTczOTEzMDQzNDc4MjYgMTIwLjk2ODYwMyAxNTUuMzMwNDM0NzgyNjA4NjggMTIwLjU5MDIwNCAxNTcuNjg2OTU2NTIxNzM5MTIgMTIwLjE4MTI4IDE2MC4wNDM0NzgyNjA4Njk1NiAxMTkuNDk3NjMxIDE2Mi40IDExOS40MDg2MDkgMTY0Ljc1NjUyMTczOTEzMDQgMTIwLjM1OTk5IDE2Ny4xMTMwNDM0NzgyNjA4NiAxMjAuNjY2NDYxIDE2OS40Njk1NjUyMTczOTEzIDEyMS4zNDU2NyAxNzEuODI2MDg2OTU2NTIxNzIgMTIwLjcwOTY0MDAwMDAwMDAxIDE3NC4xODI2MDg2OTU2NTIxNiAxMTkuODAyMzI2IDE3Ni41MzkxMzA0MzQ3ODI2IDExOS41NDk0NjggMTc4Ljg5NTY1MjE3MzkxMzA1IDExOC43NjM4MSAxODEuMjUyMTczOTEzMDQzNDYgMTE5LjU0MzI1MiAxODMuNjA4Njk1NjUyMTczOSAxMTguNjI4OTQ1IDE4NS45NjUyMTczOTEzMDQzNSAxMTguMjAzMDM3OTk5OTk5OTkgMTg4LjMyMTczOTEzMDQzNDc2IDExOC4xNjM5NjYgMTkwLjY3ODI2MDg2OTU2NTIgMTE3Ljc4MzEyNSAxOTMuMDM0NzgyNjA4Njk1NjIgMTE3LjcwODg2NiAxOTUuMzkxMzA0MzQ3ODI2MSAxMTYuODAzNjYxIDE5Ny43NDc4MjYwODY5NTY1NCAxMTYuOTg0MjU4IDIwMC4xMDQzNDc4MjYwODY5MiAxMTYuMTEwNTc3IDIwMi40NjA4Njk1NjUyMTczNyAxMTcuMTQzNjU0IDIwNC44MTczOTEzMDQzNDc4NCAxMTguODUxMDU2IDIwNy4xNzM5MTMwNDM0NzgyMiAxMTguMTc5ODM5IDIwOS41MzA0MzQ3ODI2MDg3IDExNy41NDExNDUgMjExLjg4Njk1NjUyMTczOTEgMTE3Ljc0Mjk0MyAyMTQuMjQzNDc4MjYwODY5NTUgMTE3LjYyNzgzNiAyMTYuNiAxMTYuOTU5Mzk0IDIxOC45NTY1MjE3MzkxMzA0NCAxMTcuMDM1MzE4IDIyMS4zMTMwNDM0NzgyNjA4MiAxMTcuMjQ4MTA1MDAwMDAwMDEgMjIzLjY2OTU2NTIxNzM5MTMyIDExNS43Njg2OTcgMjI2LjAyNjA4Njk1NjUyMTc0IDExNS45MzcxOTUgMjI4LjM4MjYwODY5NTY1MjE1IDExNi4wMjY5OTQgMjMwLjczOTEzMDQzNDc4MjYyIDExNS42ODI2NzIgMjMzLjA5NTY1MjE3MzkxMzA0IDExNC42MTA0MTIgMjM1LjQ1MjE3MzkxMzA0MzQ4IDExMy44OTYwMTYgMjM3LjgwODY5NTY1MjE3MzkgMTEzLjYxMTYzNCAyNDAuMTY1MjE3MzkxMzA0MzcgMTEyLjUyNjI3NiAyNDIuNTIxNzM5MTMwNDM0NzggMTExLjU1NTgwMyAyNDQuODc4MjYwODY5NTY1MjIgMTEwLjc3MjY5OCAyNDcuMjM0NzgyNjA4Njk1NjQgMTExLjU2NTkwNCAyNDkuNTkxMzA0MzQ3ODI2MSAxMTEuMTUzOTgzIDI1MS45NDc4MjYwODY5NTY1MiAxMTAuMjIxMTM5IDI1NC4zMDQzNDc4MjYwODY5NCAxMDkuNzY3OTI2IDI1Ni42NjA4Njk1NjUyMTczNSAxMTAuMzg1MTk3IDI1OS4wMTczOTEzMDQzNDc4IDExMS44MTI1NDYgMjYxLjM3MzkxMzA0MzQ3ODMgMTExLjk5MzI1NDAwMDAwMDAxIDI2My43MzA0MzQ3ODI2MDg2NSAxMTIuNzcwMzY1IDI2Ni4wODY5NTY1MjE3MzkxIDExMi45Nzg0OSAyNjguNDQzNDc4MjYwODY5NiAxMTQuMTExNTc4MDAwMDAwMDEgMjcwLjggMTEyLjY1MzcwNCAyNzMuMTU2NTIxNzM5MTMwNCAxMTMuMjU0NzY5IDI3NS41MTMwNDM0NzgyNjA4IDExNC4wMzUwOTkgMjc3Ljg2OTU2NTIxNzM5MTMgMTEyLjI1MTEwNyAyODAuMjI2MDg2OTU2NTIxNyAxMTEuNzI1OTY2IDI4Mi41ODI2MDg2OTU2NTIxNCAxMTMuMTAwODEyIDI4NC45MzkxMzA0MzQ3ODI2IDExMi4zNzIyMDggMjg3LjI5NTY1MjE3MzkxMyAxMTEuODg0MjUyIDI4OS42NTIxNzM5MTMwNDM0NCAxMTAuOTMwMzE4IDI5Mi4wMDg2OTU2NTIxNzM5IDExMC4xMTYxMzMgMjk0LjM2NTIxNzM5MTMwNDMgMTA5LjgyMTA5NSAyOTYuNzIxNzM5MTMwNDM0OCAxMDguOTc4MzgzMDAwMDAwMDEgMjk5LjA3ODI2MDg2OTU2NTIgMTA4LjM4OTUyOCAzMDEuNDM0NzgyNjA4Njk1NiAxMDcuOTQzMDg2IDMwMy43OTEzMDQzNDc4MjYxIDEwOS4wOTk3MDYgMzA2LjE0NzgyNjA4Njk1NjUgMTA5LjM4NTA4NyAzMDguNTA0MzQ3ODI2MDg2OSAxMDguMTU4MjA0IDMxMC44NjA4Njk1NjUyMTc0IDEwNy41OTc5ODcgMzEzLjIxNzM5MTMwNDM0NzggMTA2LjI4NjQxMSAzMTUuNTczOTEzMDQzNDc4MiAxMDQuNDk3NTM1IDMxNy45MzA0MzQ3ODI2MDg3IDEwMy41MjY4Mzk5OTk5OTk5OSAzMjAuMjg2OTU2NTIxNzM5MSAxMDQuNjA5NTM0IDMyMi42NDM0NzgyNjA4Njk2IDEwMy45NjIwNzEwMDAwMDAwMSAzMjUgMTAzLjQzMTE1OCIvPjwvZz48ZyBkYXRhLWFjLXdyYXBwZXItaWQ9IjY5OCIgY2xpcC1wYXRoPSJ1cmwoJnF1b3Q7I2FjX2NsaXBfam8mcXVvdDspIiBjbGlwUGF0aFVuaXRzPSJ1c2VyU3BhY2VPblVzZSIgaWQ9ImFjX2xheWVyX2pyIi8+PGcgZGF0YS1hYy13cmFwcGVyLWlkPSI2OTkiIGNsaXAtcGF0aD0idXJsKCZxdW90OyNhY19jbGlwX2pvJnF1b3Q7KSIgY2xpcFBhdGhVbml0cz0idXNlclNwYWNlT25Vc2UiIGlkPSJhY19sYXllcl9qcyIvPjxnIGRhdGEtYWMtd3JhcHBlci1pZD0iNjg1IiBjbGlwLXBhdGg9InVybCgmcXVvdDsjYWNfY2xpcF9qYSZxdW90OykiIGNsaXBQYXRoVW5pdHM9InVzZXJTcGFjZU9uVXNlIiBpZD0iYWNfbGF5ZXJfamMiPjxwYXRoIGRhdGEtYWMtd3JhcHBlci1pZD0iNjg2IiBpZD0iYWNfcGF0aF9qOCIgZmlsbD0ibm9uZSIgc3Ryb2tlPSIjYTNhM2EzIiBzdHJva2Utd2lkdGg9IjEiIGQ9Ik0gNTQgMTI1LjkgTCA1Ni4zNTY1MjE3MzkxMzA0MzYgMTI1Ljg2NzM2NiA1OC43MTMwNDM0NzgyNjA4NyAxMjUuODE2NzUgNjEuMDY5NTY1MjE3MzkxMyAxMjUuNzcyNTcyIDYzLjQyNjA4Njk1NjUyMTc0IDEyNS43MjM2MjEgNjUuNzgyNjA4Njk1NjUyMTcgMTI1LjY3NjIyNCA2OC4xMzkxMzA0MzQ3ODI2IDEyNS42Mjg4MjcgNzAuNDk1NjUyMTczOTEzMDQgMTI1LjU4MzIwNiA3Mi44NTIxNzM5MTMwNDM0OSAxMjUuNTM1ODA5IDc1LjIwODY5NTY1MjE3MzkyIDEyNS40ODgxOSA3Ny41NjUyMTczOTEzMDQzNCAxMjUuNDQyMDE0IDc5LjkyMTczOTEzMDQzNDc5IDEyNS4zOTQwNjIgODIuMjc4MjYwODY5NTY1MjIgMTI1LjM0NzQ0MiA4NC42MzQ3ODI2MDg2OTU2NCAxMjUuMjk5MDQ2IDg2Ljk5MTMwNDM0NzgyNjA5IDEyNS4yNTA1MzkgODkuMzQ3ODI2MDg2OTU2NTMgMTI1LjIwNDkxOCA5MS43MDQzNDc4MjYwODY5NiAxMjUuMTU1OTY3IDk0LjA2MDg2OTU2NTIxNzM5IDEyNS4xMDg0NTkgOTYuNDE3MzkxMzA0MzQ3ODMgMTI1LjA2MTI4NCA5OC43NzM5MTMwNDM0NzgyNiAxMjUuMDE1NjYzIDEwMS4xMzA0MzQ3ODI2MDg3IDEyNC45NjgzNzcgMTAzLjQ4Njk1NjUyMTczOTEzIDEyNC45MjE2NDYgMTA1Ljg0MzQ3ODI2MDg2OTU3IDEyNC44Nzc5MTIgMTA4LjIwMDAwMDAwMDAwMDAyIDEyNC44MzI1MTMgMTEwLjU1NjUyMTczOTEzMDQzIDEyNC43ODg0NDYgMTEyLjkxMzA0MzQ3ODI2MDg3IDEyNC43NDQyNjggMTE1LjI2OTU2NTIxNzM5MTMgMTI0LjY5Njg3MSAxMTcuNjI2MDg2OTU2NTIxNzMgMTI0LjY1NTI0NiAxMTkuOTgyNjA4Njk1NjUyMTkgMTI0LjYwOTA3IDEyMi4zMzkxMzA0MzQ3ODI2IDEyNC41NjQyMjYgMTI0LjY5NTY1MjE3MzkxMzA1IDEyNC41MTc2MDYgMTI3LjA1MjE3MzkxMzA0MzQ2IDEyNC40NzI0MjkgMTI5LjQwODY5NTY1MjE3MzkyIDEyNC40MjU1ODcwMDAwMDAwMSAxMzEuNzY1MjE3MzkxMzA0MzYgMTI0LjM3ODUyMyAxMzQuMTIxNzM5MTMwNDM0NzggMTI0LjMzMjc5MSAxMzYuNDc4MjYwODY5NTY1MjIgMTI0LjI4NTM5NCAxMzguODM0NzgyNjA4Njk1NjYgMTI0LjIzOTMyOSAxNDEuMTkxMzA0MzQ3ODI2MDggMTI0LjE5NDU5NiAxNDMuNTQ3ODI2MDg2OTU2NTIgMTI0LjE0MzY0NyAxNDUuOTA0MzQ3ODI2MDg2OTYgMTI0LjEwMDEzNSAxNDguMjYwODY5NTY1MjE3MzggMTI0LjA1MTg1IDE1MC42MTczOTEzMDQzNDc4IDEyNC4wMDUwMDggMTUyLjk3MzkxMzA0MzQ3ODI2IDEyMy45NTYzOSAxNTUuMzMwNDM0NzgyNjA4NjggMTIzLjkwOTEwNCAxNTcuNjg2OTU2NTIxNzM5MTIgMTIzLjg2MDA0MTk5OTk5OTk5IDE2MC4wNDM0NzgyNjA4Njk1NiAxMjMuODEwODY5IDE2Mi40IDEyMy43NjYzNTggMTY0Ljc1NjUyMTczOTEzMDQgMTIzLjcxMzYzMyAxNjcuMTEzMDQzNDc4MjYwODYgMTIzLjY2NTQ1OSAxNjkuNDY5NTY1MjE3MzkxMyAxMjMuNjE1NjIgMTcxLjgyNjA4Njk1NjUyMTcyIDEyMy41NjU0NDggMTc0LjE4MjYwODY5NTY1MjE2IDEyMy41MjAwNDkgMTc2LjUzOTEzMDQzNDc4MjYgMTIzLjQ3Mjg3NCAxNzguODk1NjUyMTczOTEzMDUgMTIzLjQyMDU5MyAxODEuMjUyMTczOTEzMDQzNDYgMTIzLjM2OTc1NSAxODMuNjA4Njk1NjUyMTczOSAxMjMuMzI1OTEgMTg1Ljk2NTIxNzM5MTMwNDM1IDEyMy4yNzY5NTkgMTg4LjMyMTczOTEzMDQzNDc2IDEyMy4yMzI2NyAxOTAuNjc4MjYwODY5NTY1MiAxMjMuMTg2ODI3IDE5My4wMzQ3ODI2MDg2OTU2MiAxMjMuMTQzNDI2IDE5NS4zOTEzMDQzNDc4MjYxIDEyMy4xMDI5MTEgMTk3Ljc0NzgyNjA4Njk1NjU0IDEyMy4wNTc5NTYgMjAwLjEwNDM0NzgyNjA4NjkyIDEyMy4wMTQzMzMgMjAyLjQ2MDg2OTU2NTIxNzM3IDEyMi45NzQ4MTcgMjA0LjgxNzM5MTMwNDM0Nzg0IDEyMi45MzMzMDMgMjA3LjE3MzkxMzA0MzQ3ODIyIDEyMi44OTYyMjkgMjA5LjUzMDQzNDc4MjYwODcgMTIyLjg2MDM3NiAyMTEuODg2OTU2NTIxNzM5MSAxMjIuODIwNzQ5IDIxNC4yNDM0NzgyNjA4Njk1NSAxMjIuNzgyMjMyIDIxNi42IDEyMi43NDM0OTMgMjE4Ljk1NjUyMTczOTEzMDQ0IDEyMi43MDYwODYgMjIxLjMxMzA0MzQ3ODI2MDgyIDEyMi42Njg0NTcgMjIzLjY2OTU2NTIxNzM5MTMyIDEyMi42MzA5MzkgMjI2LjAyNjA4Njk1NjUyMTc0IDEyMi41OTU1MyAyMjguMzgyNjA4Njk1NjUyMTUgMTIyLjU2MDU2NSAyMzAuNzM5MTMwNDM0NzgyNjIgMTIyLjUyNjcxIDIzMy4wOTU2NTIxNzM5MTMwNCAxMjIuNDg2NzUgMjM1LjQ1MjE3MzkxMzA0MzQ4IDEyMi40NTAzNDIgMjM3LjgwODY5NTY1MjE3MzkgMTIyLjQxMjYwMTk5OTk5OTk5IDI0MC4xNjUyMTczOTEzMDQzNyAxMjIuMzc1OTcyIDI0Mi41MjE3MzkxMzA0MzQ3OCAxMjIuMzM5MzQyIDI0NC44NzgyNjA4Njk1NjUyMiAxMjIuMzAwMDQ4IDI0Ny4yMzQ3ODI2MDg2OTU2NCAxMjIuMjYzMDg1IDI0OS41OTEzMDQzNDc4MjYxIDEyMi4yMjczNDMgMjUxLjk0NzgyNjA4Njk1NjUyIDEyMi4xODc4MjcgMjU0LjMwNDM0NzgyNjA4Njk0IDEyMi4xNDk0MjEgMjU2LjY2MDg2OTU2NTIxNzM1IDEyMi4xMTA5MDQgMjU5LjAxNzM5MTMwNDM0NzggMTIyLjA3NTkzOSAyNjEuMzczOTEzMDQzNDc4MyAxMjIuMDM3MzExIDI2My43MzA0MzQ3ODI2MDg2NSAxMjIuMDAxMDE0IDI2Ni4wODY5NTY1MjE3MzkxIDEyMS45NTgxNjggMjY4LjQ0MzQ3ODI2MDg2OTYgMTIxLjkxMjk5MSAyNzAuOCAxMjEuODYzMDQxIDI3My4xNTY1MjE3MzkxMzA0IDEyMS43OTkyMTYgMjc1LjUxMzA0MzQ3ODI2MDggMTIxLjczNTM5MDk5OTk5OTk5IDI3Ny44Njk1NjUyMTczOTEzIDEyMS42NjUxMjggMjgwLjIyNjA4Njk1NjUyMTcgMTIxLjU5MzUzMyAyODIuNTgyNjA4Njk1NjUyMTQgMTIxLjUxOTE2Mjk5OTk5OTk5IDI4NC45MzkxMzA0MzQ3ODI2IDEyMS40Mzg2ODggMjg3LjI5NTY1MjE3MzkxMyAxMjEuMzY1ODcyIDI4OS42NTIxNzM5MTMwNDM0NCAxMjEuMjgxNjIzIDI5Mi4wMDg2OTU2NTIxNzM5IDEyMS4yMDQ0NzggMjk0LjM2NTIxNzM5MTMwNDMgMTIxLjExMDEyOCAyOTYuNzIxNzM5MTMwNDM0OCAxMjEuMDIxMTA2IDI5OS4wNzgyNjA4Njk1NjUyIDEyMC45Mjc4NjYgMzAxLjQzNDc4MjYwODY5NTYgMTIwLjgzNDA3MSAzMDMuNzkxMzA0MzQ3ODI2MSAxMjAuNzQ1NzE1IDMwNi4xNDc4MjYwODY5NTY1IDEyMC42NDc4MTMgMzA4LjUwNDM0NzgyNjA4NjkgMTIwLjUwODk1MiAzMTAuODYwODY5NTY1MjE3NCAxMjAuNDYyMTEgMzEzLjIxNzM5MTMwNDM0NzggMTIwLjM1Nzc3IDMxNS41NzM5MTMwNDM0NzgyIDEyMC4yNjM3NTMwMDAwMDAwMSAzMTcuOTMwNDM0NzgyNjA4NyAxMjAuMTcyNTExIDMyMC4yODY5NTY1MjE3MzkxIDEyMC4wNjQzOTcgMzIyLjY0MzQ3ODI2MDg2OTYgMTE5Ljk2NzkzOCAzMjUgMTE5Ljg2OTI1OSIvPjwvZz48ZyBkYXRhLWFjLXdyYXBwZXItaWQ9IjY5MyIgY2xpcC1wYXRoPSJ1cmwoJnF1b3Q7I2FjX2NsaXBfamgmcXVvdDspIiBjbGlwUGF0aFVuaXRzPSJ1c2VyU3BhY2VPblVzZSIgaWQ9ImFjX2xheWVyX2prIi8+PGcgZGF0YS1hYy13cmFwcGVyLWlkPSI2OTQiIGNsaXAtcGF0aD0idXJsKCZxdW90OyNhY19jbGlwX2poJnF1b3Q7KSIgY2xpcFBhdGhVbml0cz0idXNlclNwYWNlT25Vc2UiIGlkPSJhY19sYXllcl9qbCIvPjxnIGRhdGEtYWMtd3JhcHBlci1pZD0iNjg4IiBjbGlwLXBhdGg9InVybCgmcXVvdDsjYWNfY2xpcF9qYSZxdW90OykiIGNsaXBQYXRoVW5pdHM9InVzZXJTcGFjZU9uVXNlIiBpZD0iYWNfbGF5ZXJfamQiLz48ZyBkYXRhLWFjLXdyYXBwZXItaWQ9IjY4OSIgY2xpcC1wYXRoPSJ1cmwoJnF1b3Q7I2FjX2NsaXBfamEmcXVvdDspIiBjbGlwUGF0aFVuaXRzPSJ1c2VyU3BhY2VPblVzZSIgaWQ9ImFjX2xheWVyX2plIi8+PHBhdGggZGF0YS1hYy13cmFwcGVyLWlkPSI2NTMiIGlkPSJhY19wYXRoX2ljIiBmaWxsPSJub25lIiBzdHJva2U9IiNDRUNFQ0UiIGQ9Ik0gNTQgMTM3LjUgTCAzMjYgMTM3LjUiLz48cGF0aCBkYXRhLWFjLXdyYXBwZXItaWQ9IjY1NCIgaWQ9ImFjX3BhdGhfaWQiIGZpbGw9Im5vbmUiIHN0cm9rZT0iI0NFQ0VDRSIgZD0iTSA1NC41IDEzOCBMIDU0LjUgMTQ0IE0gNTguNSAxMzggTCA1OC41IDE0NCBNIDYzLjUgMTM4IEwgNjMuNSAxNDQgTSA2OC41IDEzOCBMIDY4LjUgMTQ0IE0gNzIuNSAxMzggTCA3Mi41IDE0NCBNIDc3LjUgMTM4IEwgNzcuNSAxNDQgTSA4Mi41IDEzOCBMIDgyLjUgMTQ0IE0gODYuNSAxMzggTCA4Ni41IDE0NCBNIDkxLjUgMTM4IEwgOTEuNSAxNDQgTSA5Ni41IDEzOCBMIDk2LjUgMTQ0IE0gMTAxLjUgMTM4IEwgMTAxLjUgMTQ0IE0gMTA1LjUgMTM4IEwgMTA1LjUgMTQ0IE0gMTEwLjUgMTM4IEwgMTEwLjUgMTQ0IE0gMTE1LjUgMTM4IEwgMTE1LjUgMTQ0IE0gMTE5LjUgMTM4IEwgMTE5LjUgMTQ0IE0gMTI0LjUgMTM4IEwgMTI0LjUgMTQ0IE0gMTI5LjUgMTM4IEwgMTI5LjUgMTQ0IE0gMTM0LjUgMTM4IEwgMTM0LjUgMTQ0IE0gMTM4LjUgMTM4IEwgMTM4LjUgMTQ0IE0gMTQzLjUgMTM4IEwgMTQzLjUgMTQ0IE0gMTQ4LjUgMTM4IEwgMTQ4LjUgMTQ0IE0gMTUyLjUgMTM4IEwgMTUyLjUgMTQ0IE0gMTU3LjUgMTM4IEwgMTU3LjUgMTQ0IE0gMTYyLjUgMTM4IEwgMTYyLjUgMTQ0IE0gMTY3LjUgMTM4IEwgMTY3LjUgMTQ0IE0gMTcxLjUgMTM4IEwgMTcxLjUgMTQ0IE0gMTc2LjUgMTM4IEwgMTc2LjUgMTQ0IE0gMTgxLjUgMTM4IEwgMTgxLjUgMTQ0IE0gMTg1LjUgMTM4IEwgMTg1LjUgMTQ0IE0gMTkwLjUgMTM4IEwgMTkwLjUgMTQ0IE0gMTk1LjUgMTM4IEwgMTk1LjUgMTQ0IE0gMjAwLjUgMTM4IEwgMjAwLjUgMTQ0IE0gMjA0LjUgMTM4IEwgMjA0LjUgMTQ0IE0gMjA5LjUgMTM4IEwgMjA5LjUgMTQ0IE0gMjE0LjUgMTM4IEwgMjE0LjUgMTQ0IE0gMjE4LjUgMTM4IEwgMjE4LjUgMTQ0IE0gMjIzLjUgMTM4IEwgMjIzLjUgMTQ0IE0gMjI4LjUgMTM4IEwgMjI4LjUgMTQ0IE0gMjMzLjUgMTM4IEwgMjMzLjUgMTQ0IE0gMjM3LjUgMTM4IEwgMjM3LjUgMTQ0IE0gMjQyLjUgMTM4IEwgMjQyLjUgMTQ0IE0gMjQ3LjUgMTM4IEwgMjQ3LjUgMTQ0IE0gMjUxLjUgMTM4IEwgMjUxLjUgMTQ0IE0gMjU2LjUgMTM4IEwgMjU2LjUgMTQ0IE0gMjYxLjUgMTM4IEwgMjYxLjUgMTQ0IE0gMjY2LjUgMTM4IEwgMjY2LjUgMTQ0IE0gMjcwLjUgMTM4IEwgMjcwLjUgMTQ0IE0gMjc1LjUgMTM4IEwgMjc1LjUgMTQ0IE0gMjgwLjUgMTM4IEwgMjgwLjUgMTQ0IE0gMjg0LjUgMTM4IEwgMjg0LjUgMTQ0IE0gMjg5LjUgMTM4IEwgMjg5LjUgMTQ0IE0gMjk0LjUgMTM4IEwgMjk0LjUgMTQ0IE0gMjk5LjUgMTM4IEwgMjk5LjUgMTQ0IE0gMzAzLjUgMTM4IEwgMzAzLjUgMTQ0IE0gMzA4LjUgMTM4IEwgMzA4LjUgMTQ0IE0gMzEzLjUgMTM4IEwgMzEzLjUgMTQ0IE0gMzE3LjUgMTM4IEwgMzE3LjUgMTQ0IE0gMzIyLjUgMTM4IEwgMzIyLjUgMTQ0IE0gMzI1LjUgMTM4IEwgMzI1LjUgMTQ0Ii8+PGcgZGF0YS1hYy13cmFwcGVyLWlkPSI2NTUiIGlkPSJhY19sYXllcl9pdSI+PGcgZGF0YS1hYy13cmFwcGVyLWlkPSI2NTYiIGlkPSJhY19sYXllcl9pZiI+PGcgZGF0YS1hYy13cmFwcGVyLWlkPSI2NTciIGlkPSJhY191bm1hbmFnZWFibGUtbGF5ZXJfaWUiPjx0ZXh0IGFyaWEtaGlkZGVuPSJ0cnVlIiBmb250LXN0eWxlPSJub3JtYWwiIGZvbnQtdmFyaWFudD0ibm9ybWFsIiBmb250LWZhbWlseT0iVmVyZGFuYSwgSGVsdmV0aWNhLCBBcmlhbCwgc2Fucy1zZXJpZiIgZm9udC1zaXplPSI2IiBmb250LXdlaWdodD0ibm9ybWFsIiBsZXR0ZXItc3BhY2luZz0ibm9ybWFsIiB0ZXh0LWRlY29yYXRpb249Im5vbmUiIGZpbGw9IiM3Yzg2OGUiIG9wYWNpdHk9IjEiIHg9IjQyLjYwMTU2MjUiIHk9IjE1NSI+MTEvMjAxNDwvdGV4dD48L2c+PC9nPjxnIGRhdGEtYWMtd3JhcHBlci1pZD0iNjU4IiBpZD0iYWNfbGF5ZXJfaWgiPjxnIGRhdGEtYWMtd3JhcHBlci1pZD0iNjU5IiBpZD0iYWNfdW5tYW5hZ2VhYmxlLWxheWVyX2lnIj48dGV4dCBhcmlhLWhpZGRlbj0idHJ1ZSIgZm9udC1zdHlsZT0ibm9ybWFsIiBmb250LXZhcmlhbnQ9Im5vcm1hbCIgZm9udC1mYW1pbHk9IlZlcmRhbmEsIEhlbHZldGljYSwgQXJpYWwsIHNhbnMtc2VyaWYiIGZvbnQtc2l6ZT0iNiIgZm9udC13ZWlnaHQ9Im5vcm1hbCIgbGV0dGVyLXNwYWNpbmc9Im5vcm1hbCIgdGV4dC1kZWNvcmF0aW9uPSJub25lIiBmaWxsPSIjN2M4NjhlIiBvcGFjaXR5PSIxIiB4PSI3OS42MDE1NjI1IiB5PSIxNTUiPjAzLzIwMTY8L3RleHQ+PC9nPjwvZz48ZyBkYXRhLWFjLXdyYXBwZXItaWQ9IjY2MCIgaWQ9ImFjX2xheWVyX2lqIj48ZyBkYXRhLWFjLXdyYXBwZXItaWQ9IjY2MSIgaWQ9ImFjX3VubWFuYWdlYWJsZS1sYXllcl9paSI+PHRleHQgYXJpYS1oaWRkZW49InRydWUiIGZvbnQtc3R5bGU9Im5vcm1hbCIgZm9udC12YXJpYW50PSJub3JtYWwiIGZvbnQtZmFtaWx5PSJWZXJkYW5hLCBIZWx2ZXRpY2EsIEFyaWFsLCBzYW5zLXNlcmlmIiBmb250LXNpemU9IjYiIGZvbnQtd2VpZ2h0PSJub3JtYWwiIGxldHRlci1zcGFjaW5nPSJub3JtYWwiIHRleHQtZGVjb3JhdGlvbj0ibm9uZSIgZmlsbD0iIzdjODY4ZSIgb3BhY2l0eT0iMSIgeD0iMTE3LjYwMTU2MjUiIHk9IjE1NSI+MDcvMjAxNzwvdGV4dD48L2c+PC9nPjxnIGRhdGEtYWMtd3JhcHBlci1pZD0iNjYyIiBpZD0iYWNfbGF5ZXJfaWwiPjxnIGRhdGEtYWMtd3JhcHBlci1pZD0iNjYzIiBpZD0iYWNfdW5tYW5hZ2VhYmxlLWxheWVyX2lrIj48dGV4dCBhcmlhLWhpZGRlbj0idHJ1ZSIgZm9udC1zdHlsZT0ibm9ybWFsIiBmb250LXZhcmlhbnQ9Im5vcm1hbCIgZm9udC1mYW1pbHk9IlZlcmRhbmEsIEhlbHZldGljYSwgQXJpYWwsIHNhbnMtc2VyaWYiIGZvbnQtc2l6ZT0iNiIgZm9udC13ZWlnaHQ9Im5vcm1hbCIgbGV0dGVyLXNwYWNpbmc9Im5vcm1hbCIgdGV4dC1kZWNvcmF0aW9uPSJub25lIiBmaWxsPSIjN2M4NjhlIiBvcGFjaXR5PSIxIiB4PSIxNTQuNjAxNTYyNSIgeT0iMTU1Ij4xMS8yMDE4PC90ZXh0PjwvZz48L2c+PGcgZGF0YS1hYy13cmFwcGVyLWlkPSI2NjQiIGlkPSJhY19sYXllcl9pbiI+PGcgZGF0YS1hYy13cmFwcGVyLWlkPSI2NjUiIGlkPSJhY191bm1hbmFnZWFibGUtbGF5ZXJfaW0iPjx0ZXh0IGFyaWEtaGlkZGVuPSJ0cnVlIiBmb250LXN0eWxlPSJub3JtYWwiIGZvbnQtdmFyaWFudD0ibm9ybWFsIiBmb250LWZhbWlseT0iVmVyZGFuYSwgSGVsdmV0aWNhLCBBcmlhbCwgc2Fucy1zZXJpZiIgZm9udC1zaXplPSI2IiBmb250LXdlaWdodD0ibm9ybWFsIiBsZXR0ZXItc3BhY2luZz0ibm9ybWFsIiB0ZXh0LWRlY29yYXRpb249Im5vbmUiIGZpbGw9IiM3Yzg2OGUiIG9wYWNpdHk9IjEiIHg9IjE5Mi42MDE1NjI1IiB5PSIxNTUiPjAzLzIwMjA8L3RleHQ+PC9nPjwvZz48ZyBkYXRhLWFjLXdyYXBwZXItaWQ9IjY2NiIgaWQ9ImFjX2xheWVyX2lwIj48ZyBkYXRhLWFjLXdyYXBwZXItaWQ9IjY2NyIgaWQ9ImFjX3VubWFuYWdlYWJsZS1sYXllcl9pbyI+PHRleHQgYXJpYS1oaWRkZW49InRydWUiIGZvbnQtc3R5bGU9Im5vcm1hbCIgZm9udC12YXJpYW50PSJub3JtYWwiIGZvbnQtZmFtaWx5PSJWZXJkYW5hLCBIZWx2ZXRpY2EsIEFyaWFsLCBzYW5zLXNlcmlmIiBmb250LXNpemU9IjYiIGZvbnQtd2VpZ2h0PSJub3JtYWwiIGxldHRlci1zcGFjaW5nPSJub3JtYWwiIHRleHQtZGVjb3JhdGlvbj0ibm9uZSIgZmlsbD0iIzdjODY4ZSIgb3BhY2l0eT0iMSIgeD0iMjMwLjYwMTU2MjUiIHk9IjE1NSI+MDcvMjAyMTwvdGV4dD48L2c+PC9nPjxnIGRhdGEtYWMtd3JhcHBlci1pZD0iNjY4IiBpZD0iYWNfbGF5ZXJfaXIiPjxnIGRhdGEtYWMtd3JhcHBlci1pZD0iNjY5IiBpZD0iYWNfdW5tYW5hZ2VhYmxlLWxheWVyX2lxIj48dGV4dCBhcmlhLWhpZGRlbj0idHJ1ZSIgZm9udC1zdHlsZT0ibm9ybWFsIiBmb250LXZhcmlhbnQ9Im5vcm1hbCIgZm9udC1mYW1pbHk9IlZlcmRhbmEsIEhlbHZldGljYSwgQXJpYWwsIHNhbnMtc2VyaWYiIGZvbnQtc2l6ZT0iNiIgZm9udC13ZWlnaHQ9Im5vcm1hbCIgbGV0dGVyLXNwYWNpbmc9Im5vcm1hbCIgdGV4dC1kZWNvcmF0aW9uPSJub25lIiBmaWxsPSIjN2M4NjhlIiBvcGFjaXR5PSIxIiB4PSIyNjcuNjAxNTYyNSIgeT0iMTU1Ij4xMS8yMDIyPC90ZXh0PjwvZz48L2c+PGcgZGF0YS1hYy13cmFwcGVyLWlkPSI2NzAiIGlkPSJhY19sYXllcl9pdCI+PGcgZGF0YS1hYy13cmFwcGVyLWlkPSI2NzEiIGlkPSJhY191bm1hbmFnZWFibGUtbGF5ZXJfaXMiPjx0ZXh0IGFyaWEtaGlkZGVuPSJ0cnVlIiBmb250LXN0eWxlPSJub3JtYWwiIGZvbnQtdmFyaWFudD0ibm9ybWFsIiBmb250LWZhbWlseT0iVmVyZGFuYSwgSGVsdmV0aWNhLCBBcmlhbCwgc2Fucy1zZXJpZiIgZm9udC1zaXplPSI2IiBmb250LXdlaWdodD0ibm9ybWFsIiBsZXR0ZXItc3BhY2luZz0ibm9ybWFsIiB0ZXh0LWRlY29yYXRpb249Im5vbmUiIGZpbGw9IiM3Yzg2OGUiIG9wYWNpdHk9IjEiIHg9IjMwNS42MDE1NjI1IiB5PSIxNTUiPjAzLzIwMjQ8L3RleHQ+PC9nPjwvZz48L2c+PHBhdGggZGF0YS1hYy13cmFwcGVyLWlkPSI2NzIiIGlkPSJhY19wYXRoX2l2IiBmaWxsPSJub25lIiBzdHJva2U9IiNDRUNFQ0UiIGQ9Ik0gNTQuNSAyNiBMIDU0LjUgMTM4Ii8+PHBhdGggZGF0YS1hYy13cmFwcGVyLWlkPSI2NzMiIGlkPSJhY19wYXRoX2l3IiBmaWxsPSJub25lIiBzdHJva2U9IiNDRUNFQ0UiIGQ9Ik0gNTQgMTM3LjUgTCA0OCAxMzcuNSBNIDU0IDEwOS41IEwgNDggMTA5LjUgTSA1NCA4MS41IEwgNDggODEuNSBNIDU0IDUzLjUgTCA0OCA1My41IE0gNTQgMjYuNSBMIDQ4IDI2LjUiLz48ZyBkYXRhLWFjLXdyYXBwZXItaWQ9IjY3NCIgaWQ9ImFjX2xheWVyX2o3Ij48ZyBkYXRhLWFjLXdyYXBwZXItaWQ9IjY3NSIgaWQ9ImFjX2xheWVyX2l5Ij48ZyBkYXRhLWFjLXdyYXBwZXItaWQ9IjY3NiIgaWQ9ImFjX3VubWFuYWdlYWJsZS1sYXllcl9peCI+PHRleHQgYXJpYS1oaWRkZW49InRydWUiIGZvbnQtc3R5bGU9Im5vcm1hbCIgZm9udC12YXJpYW50PSJub3JtYWwiIGZvbnQtZmFtaWx5PSJWZXJkYW5hLCBIZWx2ZXRpY2EsIEFyaWFsLCBzYW5zLXNlcmlmIiBmb250LXNpemU9IjYiIGZvbnQtd2VpZ2h0PSJub3JtYWwiIGxldHRlci1zcGFjaW5nPSJub3JtYWwiIHRleHQtZGVjb3JhdGlvbj0ibm9uZSIgZmlsbD0iIzdjODY4ZSIgb3BhY2l0eT0iMSIgeD0iMzYuMTg1NTQ2ODc1IiB5PSIxMzkiPiQwPC90ZXh0PjwvZz48L2c+PGcgZGF0YS1hYy13cmFwcGVyLWlkPSI2NzciIGlkPSJhY19sYXllcl9qMCI+PGcgZGF0YS1hYy13cmFwcGVyLWlkPSI2NzgiIGlkPSJhY191bm1hbmFnZWFibGUtbGF5ZXJfaXoiPjx0ZXh0IGFyaWEtaGlkZGVuPSJ0cnVlIiBmb250LXN0eWxlPSJub3JtYWwiIGZvbnQtdmFyaWFudD0ibm9ybWFsIiBmb250LWZhbWlseT0iVmVyZGFuYSwgSGVsdmV0aWNhLCBBcmlhbCwgc2Fucy1zZXJpZiIgZm9udC1zaXplPSI2IiBmb250LXdlaWdodD0ibm9ybWFsIiBsZXR0ZXItc3BhY2luZz0ibm9ybWFsIiB0ZXh0LWRlY29yYXRpb249Im5vbmUiIGZpbGw9IiM3Yzg2OGUiIG9wYWNpdHk9IjEiIHg9IjE0LjkzMDY2NDA2MjUiIHk9IjExMSI+JDI1MCwwMDA8L3RleHQ+PC9nPjwvZz48ZyBkYXRhLWFjLXdyYXBwZXItaWQ9IjY3OSIgaWQ9ImFjX2xheWVyX2oyIj48ZyBkYXRhLWFjLXdyYXBwZXItaWQ9IjY4MCIgaWQ9ImFjX3VubWFuYWdlYWJsZS1sYXllcl9qMSI+PHRleHQgYXJpYS1oaWRkZW49InRydWUiIGZvbnQtc3R5bGU9Im5vcm1hbCIgZm9udC12YXJpYW50PSJub3JtYWwiIGZvbnQtZmFtaWx5PSJWZXJkYW5hLCBIZWx2ZXRpY2EsIEFyaWFsLCBzYW5zLXNlcmlmIiBmb250LXNpemU9IjYiIGZvbnQtd2VpZ2h0PSJub3JtYWwiIGxldHRlci1zcGFjaW5nPSJub3JtYWwiIHRleHQtZGVjb3JhdGlvbj0ibm9uZSIgZmlsbD0iIzdjODY4ZSIgb3BhY2l0eT0iMSIgeD0iMTQuOTMwNjY0MDYyNSIgeT0iODQiPiQ1MDAsMDAwPC90ZXh0PjwvZz48L2c+PGcgZGF0YS1hYy13cmFwcGVyLWlkPSI2ODEiIGlkPSJhY19sYXllcl9qNCI+PGcgZGF0YS1hYy13cmFwcGVyLWlkPSI2ODIiIGlkPSJhY191bm1hbmFnZWFibGUtbGF5ZXJfajMiPjx0ZXh0IGFyaWEtaGlkZGVuPSJ0cnVlIiBmb250LXN0eWxlPSJub3JtYWwiIGZvbnQtdmFyaWFudD0ibm9ybWFsIiBmb250LWZhbWlseT0iVmVyZGFuYSwgSGVsdmV0aWNhLCBBcmlhbCwgc2Fucy1zZXJpZiIgZm9udC1zaXplPSI2IiBmb250LXdlaWdodD0ibm9ybWFsIiBsZXR0ZXItc3BhY2luZz0ibm9ybWFsIiB0ZXh0LWRlY29yYXRpb249Im5vbmUiIGZpbGw9IiM3Yzg2OGUiIG9wYWNpdHk9IjEiIHg9IjE0LjkzMDY2NDA2MjUiIHk9IjU2Ij4kNzUwLDAwMDwvdGV4dD48L2c+PC9nPjxnIGRhdGEtYWMtd3JhcHBlci1pZD0iNjgzIiBpZD0iYWNfbGF5ZXJfajYiPjxnIGRhdGEtYWMtd3JhcHBlci1pZD0iNjg0IiBpZD0iYWNfdW5tYW5hZ2VhYmxlLWxheWVyX2o1Ij48dGV4dCBhcmlhLWhpZGRlbj0idHJ1ZSIgZm9udC1zdHlsZT0ibm9ybWFsIiBmb250LXZhcmlhbnQ9Im5vcm1hbCIgZm9udC1mYW1pbHk9IlZlcmRhbmEsIEhlbHZldGljYSwgQXJpYWwsIHNhbnMtc2VyaWYiIGZvbnQtc2l6ZT0iNiIgZm9udC13ZWlnaHQ9Im5vcm1hbCIgbGV0dGVyLXNwYWNpbmc9Im5vcm1hbCIgdGV4dC1kZWNvcmF0aW9uPSJub25lIiBmaWxsPSIjN2M4NjhlIiBvcGFjaXR5PSIxIiB4PSI4LjkzMzU5Mzc1IiB5PSIyOCI+JDEsMDAwLDAwMDwvdGV4dD48L2c+PC9nPjwvZz48cGF0aCBkYXRhLWFjLXdyYXBwZXItaWQ9IjcwMCIgcG9pbnRlci1ldmVudHM9Im5vbmUiIGlkPSJhY19wYXRoX2p0IiBmaWxsPSJub25lIiBzdHJva2U9IiM5NjlFQTUiIGQ9Ik0gMCwwIi8+PHBhdGggZGF0YS1hYy13cmFwcGVyLWlkPSI3MDEiIHBvaW50ZXItZXZlbnRzPSJub25lIiBpZD0iYWNfcGF0aF9qdSIgZmlsbD0ibm9uZSIgc3Ryb2tlPSJub25lIiBkPSJNIDAsMCIvPjxnIGRhdGEtYWMtd3JhcHBlci1pZD0iNjMyIiB0cmFuc2Zvcm09Im1hdHJpeCgxLDAsMCwxLDQzLjUyMDc1MTk1MzEyNSwxMCkiIGNsaXAtcGF0aD0idXJsKCZxdW90OyNhY19jbGlwX2kxJnF1b3Q7KSIgY2xpcFBhdGhVbml0cz0idXNlclNwYWNlT25Vc2UiIGlkPSJhY19sYXllcl9pMyI+PGcgZGF0YS1hYy13cmFwcGVyLWlkPSI2MzMiIGlkPSJhY19sYXllcl9oeiI+PGcgZGF0YS1hYy13cmFwcGVyLWlkPSI2MzQiIGlkPSJhY19sYXllcl9ocSI+PHRleHQgZGF0YS1hYy13cmFwcGVyLWlkPSI2MzUiIGZvbnQtc3R5bGU9Im5vcm1hbCIgZm9udC12YXJpYW50PSJub3JtYWwiIGZvbnQtZmFtaWx5PSJWZXJkYW5hLCBIZWx2ZXRpY2EsIEFyaWFsLCBzYW5zLXNlcmlmIiBmb250LXNpemU9IjUiIGZvbnQtd2VpZ2h0PSJub3JtYWwiIGZpbGw9IiM3Yzg2OGUiIGxldHRlci1zcGFjaW5nPSJub3JtYWwiIHRleHQtZGVjb3JhdGlvbj0ibm9uZSIgZGlyZWN0aW9uPSJsdHIiIHRleHQtYW5jaG9yPSJzdGFydCIgeD0iMTAiIHk9IjUiIGFyaWEtaGlkZGVuPSJ0cnVlIiBpZD0iYWNfdGV4dF9obiIgc3R5bGU9InVzZXItc2VsZWN0OiBub25lOyBmb250LWZhbWlseTogVmVyZGFuYSwgSGVsdmV0aWNhLCBBcmlhbCwgc2Fucy1zZXJpZjsgb3BhY2l0eTogMTsgY3Vyc29yOiBwb2ludGVyOyI+PHRzcGFuIHg9IjEwIiBkeT0iMCI+RnVuZDwvdHNwYW4+PC90ZXh0PjxwYXRoIGRhdGEtYWMtd3JhcHBlci1pZD0iNjM2IiB0cmFuc2Zvcm09Im1hdHJpeCgxLDAsMCwxLDAsMC41KSIgaWQ9ImFjX3BhdGhfaG8iIGZpbGw9IiM2MTIxNDEiIHN0cm9rZT0iIzYxMjE0MSIgc3Ryb2tlLXdpZHRoPSIxIiBkPSJNIDAgMCBMIDUgMCA1IDUgMCA1IFoiIHN0eWxlPSJjdXJzb3I6IHBvaW50ZXI7Ii8+PHBhdGggZGF0YS1hYy13cmFwcGVyLWlkPSI2MzciIGlkPSJhY19yZWN0X2hwIiBmaWxsPSIjRkZGRkZGIiBmaWxsLW9wYWNpdHk9IjAuMDAwMDEiIHN0cm9rZT0ibm9uZSIgZD0iTSAwIDAgTCAyMy4zMjgxMjUgMCAyMy4zMjgxMjUgNiAwIDYgMCAwIFoiIHN0eWxlPSJjdXJzb3I6IHBvaW50ZXI7Ii8+PC9nPjxnIGRhdGEtYWMtd3JhcHBlci1pZD0iNjM4IiB0cmFuc2Zvcm09Im1hdHJpeCgxLDAsMCwxLDM4LjMyODEyNSwwKSIgaWQ9ImFjX2xheWVyX2h1Ij48dGV4dCBkYXRhLWFjLXdyYXBwZXItaWQ9IjYzOSIgZm9udC1zdHlsZT0ibm9ybWFsIiBmb250LXZhcmlhbnQ9Im5vcm1hbCIgZm9udC1mYW1pbHk9IlZlcmRhbmEsIEhlbHZldGljYSwgQXJpYWwsIHNhbnMtc2VyaWYiIGZvbnQtc2l6ZT0iNSIgZm9udC13ZWlnaHQ9Im5vcm1hbCIgZmlsbD0iIzdjODY4ZSIgbGV0dGVyLXNwYWNpbmc9Im5vcm1hbCIgdGV4dC1kZWNvcmF0aW9uPSJub25lIiBkaXJlY3Rpb249Imx0ciIgdGV4dC1hbmNob3I9InN0YXJ0IiB4PSIxMCIgeT0iNSIgYXJpYS1oaWRkZW49InRydWUiIGlkPSJhY190ZXh0X2hyIiBzdHlsZT0idXNlci1zZWxlY3Q6IG5vbmU7IGZvbnQtZmFtaWx5OiBWZXJkYW5hLCBIZWx2ZXRpY2EsIEFyaWFsLCBzYW5zLXNlcmlmOyBvcGFjaXR5OiAxOyBjdXJzb3I6IHBvaW50ZXI7Ij48dHNwYW4geD0iMTAiIGR5PSIwIj5NU0NJIFdvcmxkIFRvdGFsIFJldHVybiBJbmRleCAobmV0LCBBVUQpPC90c3Bhbj48L3RleHQ+PHBhdGggZGF0YS1hYy13cmFwcGVyLWlkPSI2NDAiIHRyYW5zZm9ybT0ibWF0cml4KDEsMCwwLDEsMCwwLjUpIiBpZD0iYWNfcGF0aF9ocyIgZmlsbD0iIzVmNWY1ZiIgc3Ryb2tlPSIjNWY1ZjVmIiBzdHJva2Utd2lkdGg9IjEiIGQ9Ik0gMCAwIEwgNSAwIDUgNSAwIDUgWiIgc3R5bGU9ImN1cnNvcjogcG9pbnRlcjsiLz48cGF0aCBkYXRhLWFjLXdyYXBwZXItaWQ9IjY0MSIgaWQ9ImFjX3JlY3RfaHQiIGZpbGw9IiNGRkZGRkYiIGZpbGwtb3BhY2l0eT0iMC4wMDAwMSIgc3Ryb2tlPSJub25lIiBkPSJNIDAgMCBMIDExOC4yNDgwNDY4NzUgMCAxMTguMjQ4MDQ2ODc1IDYgMCA2IDAgMCBaIiBzdHlsZT0iY3Vyc29yOiBwb2ludGVyOyIvPjwvZz48ZyBkYXRhLWFjLXdyYXBwZXItaWQ9IjY0MiIgdHJhbnNmb3JtPSJtYXRyaXgoMSwwLDAsMSwxNzEuNTc2MTcxODc1LDApIiBpZD0iYWNfbGF5ZXJfaHkiPjx0ZXh0IGRhdGEtYWMtd3JhcHBlci1pZD0iNjQzIiBmb250LXN0eWxlPSJub3JtYWwiIGZvbnQtdmFyaWFudD0ibm9ybWFsIiBmb250LWZhbWlseT0iVmVyZGFuYSwgSGVsdmV0aWNhLCBBcmlhbCwgc2Fucy1zZXJpZiIgZm9udC1zaXplPSI1IiBmb250LXdlaWdodD0ibm9ybWFsIiBmaWxsPSIjN2M4NjhlIiBsZXR0ZXItc3BhY2luZz0ibm9ybWFsIiB0ZXh0LWRlY29yYXRpb249Im5vbmUiIGRpcmVjdGlvbj0ibHRyIiB0ZXh0LWFuY2hvcj0ic3RhcnQiIHg9IjEwIiB5PSI1IiBhcmlhLWhpZGRlbj0idHJ1ZSIgaWQ9ImFjX3RleHRfaHYiIHN0eWxlPSJ1c2VyLXNlbGVjdDogbm9uZTsgZm9udC1mYW1pbHk6IFZlcmRhbmEsIEhlbHZldGljYSwgQXJpYWwsIHNhbnMtc2VyaWY7IG9wYWNpdHk6IDE7IGN1cnNvcjogcG9pbnRlcjsiPjx0c3BhbiB4PSIxMCIgZHk9IjAiPlJCQSBDYXNoIFJhdGUgcGx1cyAzJTwvdHNwYW4+PC90ZXh0PjxwYXRoIGRhdGEtYWMtd3JhcHBlci1pZD0iNjQ0IiB0cmFuc2Zvcm09Im1hdHJpeCgxLDAsMCwxLDAsMC41KSIgaWQ9ImFjX3BhdGhfaHciIGZpbGw9IiNhM2EzYTMiIHN0cm9rZT0iI2EzYTNhMyIgc3Ryb2tlLXdpZHRoPSIxIiBkPSJNIDAgMCBMIDUgMCA1IDUgMCA1IFoiIHN0eWxlPSJjdXJzb3I6IHBvaW50ZXI7Ii8+PHBhdGggZGF0YS1hYy13cmFwcGVyLWlkPSI2NDUiIGlkPSJhY19yZWN0X2h4IiBmaWxsPSIjRkZGRkZGIiBmaWxsLW9wYWNpdHk9IjAuMDAwMDEiIHN0cm9rZT0ibm9uZSIgZD0iTSAwIDAgTCA3MS4zODIzMjQyMTg3NSAwIDcxLjM4MjMyNDIxODc1IDYgMCA2IDAgMCBaIiBzdHlsZT0iY3Vyc29yOiBwb2ludGVyOyIvPjwvZz48L2c+PC9nPjwvZz48L2c+PC9zdmc+

[jsonhpid] => 24790

[jsonhpid2] => 24791

)

)